Happy Friday! In 1992, Congress passed a law designating July 28 as National Buffalo Soldiers Day.

The first peacetime all-African American Regiments, Buffalo Soldiers, were formed on this day after the end of the Civil War. They were frontier regiments, so the 9th and 10th Calvary Divisions protected the western edge of the nation (hence their name) as the country pushed westward. The 10th Calvary was based at Fort Leavenworth, Kansas, where Colin Powell dedicated a monument to the soldiers on the first Buffalo Soldiers Day. In 1944, the Army activated both regiments and integrated them into the rest of the Army for service in World War II. On September 6, 2005, Mark Matthews — the oldest living Buffalo Soldier — died at 111 years old. He is buried at Arlington National Cemetery.

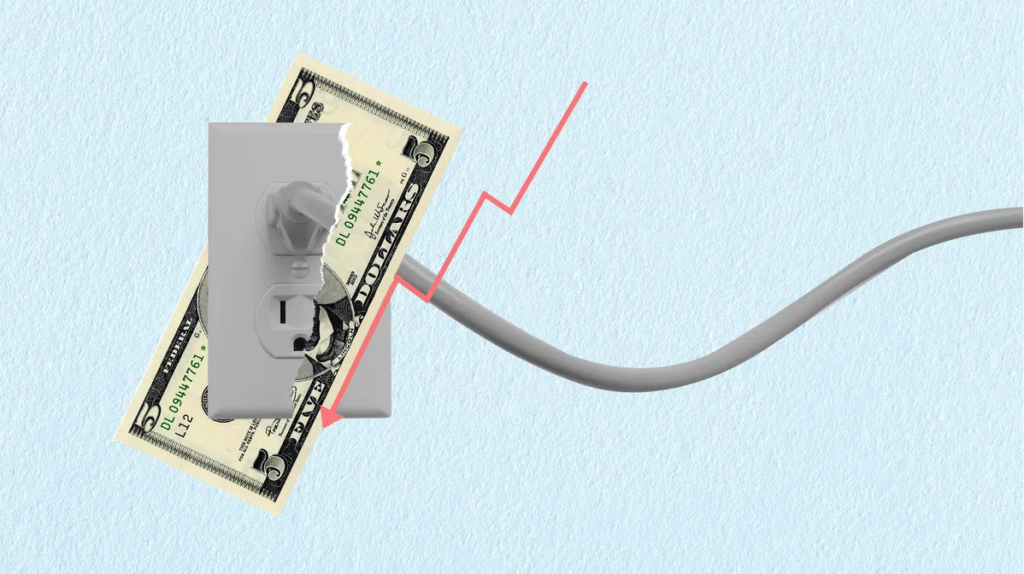

1 big thing: Senate bill would thwart real estate investing

Eight Senators introduced the “Stop Predatory Investing Act” (Senate Bill 2224) to the Senate Banking Committee earlier this month.

-

Why it matters: The bill would amend the US Tax Code to disallow the interest deduction and depreciation of properties owned by investors who own 50 or more one-to-four-family residential rental properties.

By the numbers: According to the bill’s sponsors:

-

The U.S. is short 3.8 million homes, making it almost impossible for homebuyers to find a home they can afford.

-

Institutional buyers bought over 13% of homes sold in 2021.

-

Such rates were as high as 28% in Texas and 19% in Georgia.

-

The share of investor purchases made by investors with portfolios of 100 properties or more grew from 14% in September 2020 to 26% in September 2021.

If it ever becomes law as it is proposed, the bill would prohibit an investor who buys 50 or more 1-4 family homes after the law’s effective date from deducting interest or depreciation on those properties.

Yes, but: The law would not apply to homes constructed by the taxpayer or to homes that the taxpayer buys after construction but before first being occupied as a primary residence by anyone.

-

Another exception is available if the taxpayer sells the property to a non-profit or a person buying it as a primary residence. The taxpayer can take all accrued interest deductions and depreciation at that point.

Our thought bubble: This bill will likely pass out of the Banking Committee favorably, considering that almost every committee member of the majority is a sponsor.

-

However, like most legislation, if it makes it to the floor for debate, it could be filibustered unless at least 60 senators are willing to allow it to be voted upon.

-

However, even if it passes the Senate, the chances of it being taken up in the House are extremely slim, given that chamber’s distaste for regulation.

Go deeper: The bill text at TaxNotes. Sign up to follow the bill through the Senate.

2. Too anonymous?

We enjoy saying our tagline: “‘None of your business’ is our business.” But sometimes, we see land trusts coupled with limited liability company trustees that are too anonymous.

-

Why it matters: If no one can verify who has authorization to lease, sell, mortgage, or convey a piece of real estate, then it’s easier for fraudsters to steal rent or equity from the property.

I recently saw a Youtube video by a non-lawyer selling land trust preparation services nationwide.

-

He giddily described how his company would create (and charge for) a Wyoming LLC for their customer and then use that company to be the trustee of a land trust that they also create.

Having worked in title insurance and closings since 1996, I’ve seen the problems this can cause and recommend against it.

-

Anyone can generate an operating agreement, sign an affidavit, and then use those to sell or mortgage the property held in trust.

-

Anyone can say they own the trustee company and advertise the trust property for lease. They then take the first and last month’s rent plus a security deposit from a hapless tenant who moves into the trust’s property based on a fraudulent, unauthorized lease.

Using a third-party trustee like MyLandTrustee.com is a form of protection against such fraudsters, and it’s cheaper because fees to create and file a Wyoming, Delaware, or Nevada LLC are unnecessary.

-

Title and closing agents or tenants can locate us with a simple internet search to contact us and verify whether the property is for sale, mortgage, or rent.

-

They can view our Florida corporate records online to ensure that we have the authority to execute documents on behalf of the trustee and the trust.

-

We contact the beneficiaries also to verify that the property is being sold, mortgaged, or rented before signing anything.

The bottom line: Be wary of non-lawyers selling “total anonymity” regarding real estate. Sometimes, finding the right person to verify information can prevent the loss of money or the property itself, and that’s a good thing.

3. Catch up fast

-

California and New York lost high earners ($200K/year or more) during the pandemic mostly to Florida and Texas. Bloomberg

-

Foreclosure activity ticks up to pre-pandemic levels, but still only a smidgen of what it was during the Great Recession. Attom

-

Morningstar predicts that home prices will fall on average 4% to 6% over the next couple of years until home affordability is reached, and lower mortgage rates will be the lever that has to be pulled to do it. Yahoo Finance

-

More great economic news following last week’s compendium of good news: GDP rose at a 2.4% annual rate instead of slowing to 1.8% as projected; durable goods outpaced projections, pending home sales jumped for the first time in four months, and unemployment claims fell. The chances of a recession continue to shrink. Bloomberg

-

For the first time in recorded history, office space in the US declined. Since January, only 5 million square feet of new space broke ground for construction, while 14.7 million square feet was removed through demolition or repurposing. JLL

4. Pic of the day

I don’t think it’s any secret that we operate MyLandTrustee on the Entrepreneurial Operating System (EOS) as explained by Gino Wickman in his book Traction.

When embarking on the EOS journey, the first thing you do as an organization is to have a “Vision Day,” where you dig for and discover your company’s mission and the structure it will need to achieve the objectives to fulfill its mission.

I often catch myself describing roles in our Accountability Chart with military terms.

-

Visionaries are fleet captains who, instead of determining where the fleet will go next and why, envision the targets the business will pursue.

-

Integrators are the first officers who handle the daily grinding and implementation of the strategy to reach the visionary’s targets.

-

Underneath them, there are divisions, teams, and everyone else it takes to do the day-to-day work needed to keep the ships running, the crew fed and paid, and actually to shoot the guns.

Everyone from the visionary all the way day to the soldier on the field must know the vision and the objective with clarity and simplicity so they are all moving in the same direction.

Smart entrepreneurs first determine whether they are a general (visionary) or a first officer (integrator).

The bottom line: Once it is clear who will determine the ship’s direction and who will make it go, everyone in the chain of command will have clarity.

-

The crew will also know where they stand and where they’re going.

-

And they’ll fight like hell to get you there.

Go deeper: For more information on the photo above, check out the National Archives. And for a well-known song about Buffalo Soldiers, Bob Marley’s is the best.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

-

Have an idea or issue to share? Email us.

-

Follow MyLandTrustee and Joseph E Seagle PA on LinkedIN,

Be on the lookout for our next issue!