Trust This. This Memorial Day, Veterans are Fighting Foreclosures

00 Trust This. Posts 🎖️ Trust This: This Memorial Day, Veterans are fighting foreclosures 🎖️ Trust This: This Memorial Day, Veterans are fighting foreclosures and

There are only six states that have land trust enabling legislation: Illinois, Florida, Hawaii, Indiana, North Dakota and Virginia. And they all work a little differently.

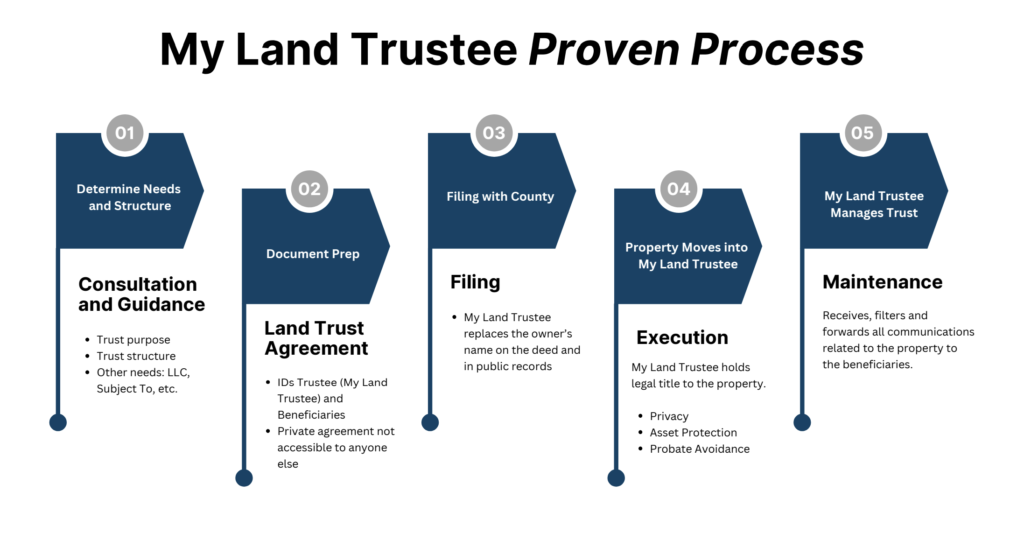

The Florida land trust is a legal way to protect the identity of a property’s true owner by creating a unique legal relationship between a trustee and a beneficiary. Property owners with large property holdings or who have name recognition with the public often seek ways to protect their anonymity. A land trust provides privacy of ownership, ease of management, asset separation, and easier transferability of ownership.

Contact us today to discuss how the land trust could work for you.

The Florida land trust is a unique relationship between the trustee and beneficiary that protects the privacy of the property’s true owner. When used properly, the land trust provides privacy of ownership, ease of management, asset separation, and easier transferability of ownership.

We hold properties in trust for investors and others who desire that extra layer of privacy and asset protection in their real estate ownership and transactions. Our name appears on the Official Records, in the County Property Appraiser and Tax Collector Records, on leases, deeds, and permit applications. Your name doesn’t. We and you are the only ones who know you own the property.

00 Trust This. Posts 🎖️ Trust This: This Memorial Day, Veterans are fighting foreclosures 🎖️ Trust This: This Memorial Day, Veterans are fighting foreclosures and

Trust This. Posts Trust This: Florida’s new non-compete bill Trust This: Florida’s new non-compete bill and the feds’ definition of “independent contractor” reverts Joseph Seagle

00 Trust This. Posts 🎯 Trust This: Targeting Section 8 for deletion 🎯 Trust This: Targeting Section 8 for deletion And the Florida legislature votes

© 2024 All rights reserved