👋 Happy Friday! Don’t forget that 🌞 Daylight 🛟 Savings 🕑 Time ends this Sunday morning when we 🍂 fall back an hour. Enjoy the extra hour of sleep!

Situation Awareness: 2023 tax bills are flowing into our offices steadily from all 65 counties where we currently hold properties in trust. We are working as diligently and fast as possible to scan and share them with you via an e-mail link to the portal. However, if — by November 27 — you have not received your bill for a property we hold in trust for you, please e-mail us at hello@mylandtrustee.com to let us know so we can double-check and get it to you by the end of the month. Of course, you can always beat us to it by going directly to the county tax collectors’ sites and pulling a copy of any tax bill. While there, you can also pay the bill online with a credit card or e-check immediately.

State of play: We are moving into our new offices down the street from our current office on November 10, so our offices will be closed on November 10 and 13 for the move of internet, phones, and other equipment. After November 9, our new physical address will be 1901 West Colonial Drive, First Floor, Orlando, FL 32804. Of course, our mailing address will remain the same: PO Box 547945, Orlando, FL 32854-7945. Please update your records and notify your insurance carriers and HOAs of the change.

1 big thing: Lawsuits alone don’t drive insurance premiums

Florida’s legislature has passed multiple insurance law reforms aiming to retain insurers in the state and stabilize insurance rates. As justification, legislators painted a picture of irresponsible, excessive lawsuits as the main driver for the increasing insurance costs.

Why it matters: The new laws passed in a couple of special sessions made it much more challenging for consumers to sue their insurance companies for bad faith in denying claims payments, among other things.

But are “frivolous” lawsuits the cause of insurers’ woes?

-

The evidence supporting that narrative is shaky at best.

-

Recently, the Tampa Bay Times performed an investigation into this theory that resulted in a more nuanced perspective.

-

While lawsuits have stoked the fires of Florida’s insurance crisis, they’re not solely responsible for insurers exiting the state or escalating insurance rates.

State of play: The Tampa Bay Times investigation suggests this is a complex issue with multiple causes:

-

Florida’s unique risk profile. The state’s high rates of natural disasters like hurricanes significantly influence insurance rates.

-

The role of reinsurance. Reinsurance (insurance for insurance companies) also plays a role in property owner premiums.

-

The business practices of insurance companies. Insurers’ internal attempts to reduce payouts may also contribute to the high litigation rate.

Still, the lawsuits can’t be helpful. Insurers have made it clear that litigation impacts their operations.

-

The high volume of lawsuits and the cost of managing those lawsuits have made it necessary for insurers to increase premiums.

-

Legislators’ reforms focus on curbing these lawsuits, which should reduce legal fees for insurers and, in theory, allow insurers to reduce their premiums.

It still won’t fix everything. The Tampa Bay Times piece suggests that it might be more responsible for policymakers to consider the many factors at play here before enacting reforms focused on only one part of the issue.

Go deeper: Visit our YouTube channel to be the first to see my interview with Colleen Pacheco, insurance agent extraordinaire, as we discuss Florida’s insurance issues.

Scott Maxwell at the Orlando Sentinel also had an interesting piece about this issue recently.

2. The dream turns into a coma for some

The average income buyers need to afford a first home is around $115K.

Why it matters: Homeowners must hold onto that first home for at least a decade before seeing any profit.

Maybe we need to reassess what homeownership means.

The data is in, real estate costs are rising fast, but wages are not.

-

The one-two punch makes it difficult and, in many cases, impossible for the average American to enter the housing market.

-

It has been a historic axiom that a first home is a good investment.

But is homeownership all it’s cracked up to be when home values aren’t keeping up with the costs of buying and maintaining that home? For many, the financial burden of a mortgage plus taxes plus constant upkeep isn’t worth the toll it takes on a person’s quality of life.

Yes, but: Social attitudes haven’t yet caught up to this data. Most Americans still see homeownership as an important milestone, meaning security, stability, and a real stake in the American dream.

Some say that the dream (imperative?) is holding us back as a nation because the costs of homeownership detract from, rather than add to, the average American’s quality of life, the real estate market, and the economy as a whole.

As real estate professionals, we must adjust our strategies and rethink how we educate hopeful homebuyers.

-

We must be honest with our clients about what long-term homeownership looks like in today’s climate.

-

We must also partner with our clients to make informed decisions based on their financial situation and complex data.

We must also advocate for policy changes.

-

The rising rates associated with the housing crisis result from systemic problems in the industry and the market.

-

We need comprehensive solutions that do more than address surface-level challenges. This could involve re-examining zoning laws or tackling how quickly mortgage rates can skyrocket.

Our thought bubble: Being active in sculpting home ownership policies will be part of our daily profession.

Have you ever contacted an elected official about a real estate policy or law change? |

3. Catch up fast

-

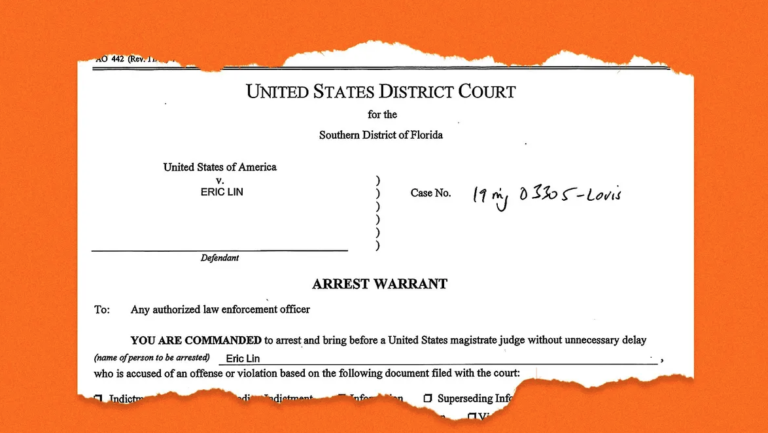

HUGE FOLLOW UP to our Oct. 20 article about the pending buyer commission lawsuit. The jury in the suit awarded a $1.78 billion compensatory award against NAR, Keller Williams, and Homeservices of America in the civil trial in Kansas City, MO. The jury found that the companies and NAR had colluded to inflate or maintain high commission rates. If damages are trebled, the companies could face a judgment of $5.36 billion. Copycat lawsuits across the country could mean the end of buyer-agent commissions being paid from the listing agent’s commission, leading to up to 1 million buyer-side REALTORs leaving the profession. HousingWire and Washington Post

-

The chaos/shakeup of NAR’s leadership got worse on Thursday as its longtime CEO left in the wake of the aforementioned judgment in Kansas City. HousingWire

-

The Fed held its lending rate steady this week, not raising it since July. However, Jerome Powell left the door open for further tightening if certain areas of inflation don’t cool off. New York Times

-

The market for second home sales in vacation hot spots is drying up, except for buyers who don’t need financing. StreetInsider

-

The White House is pushing policy changes that will make it easier and more profitable to convert empty commercial office buildings into affordable residential housing. Philadelphia Inquirer

4. Pic of the day

|

For the last few days this week, I’ve been living our company’s core value of “Be Growing” by attending the Crisp Game Changers Summit in Alpharetta, Georgia. Why it matters: Our core values aren’t just words on a wall or website.

The theme of this year’s summit is “Built Not Born,” going back to the familiar “nature versus nurture” argument on leadership. The big question presented first thing on Thursday morning was whether leaders are born as such or whether they learn to be leaders. Of course, everyone is born with certain traits and abilities for risk tolerance, ambiguity tolerance, organization, sleep circadian rhythms, energy, and intro/extroversion. But it’s what we learn to do with those traits that can make us either great or mediocre leaders. One of the other lawyers at the Summit represented Flo Rida in his suit against Celsius, where he won an $82.6 million verdict.

What they’re saying: Here are some other tidbits of wisdom from Thursday’s other speakers:

The bottom line: To build a business and not just create a job for yourself, you have to be focused on growing your knowledge, including how to be a better leader. It gives you a good feeling. |

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Be on the lookout for our next issue! 👋 |