|

Happy 🎃 Halloween 👻 Friday! Our goal is to inform and not scare, so no “boos” here! Yes, but: Just i

|

|

|

|

|

Trust This.

By Joseph E. Seagle, Esq. ● Oct 28, 2022

Smart Brevity® count: 3.5 mins...884 words

Happy 🎃 Halloween 👻 Friday! Our goal is to inform and not scare, so no “boos” here!

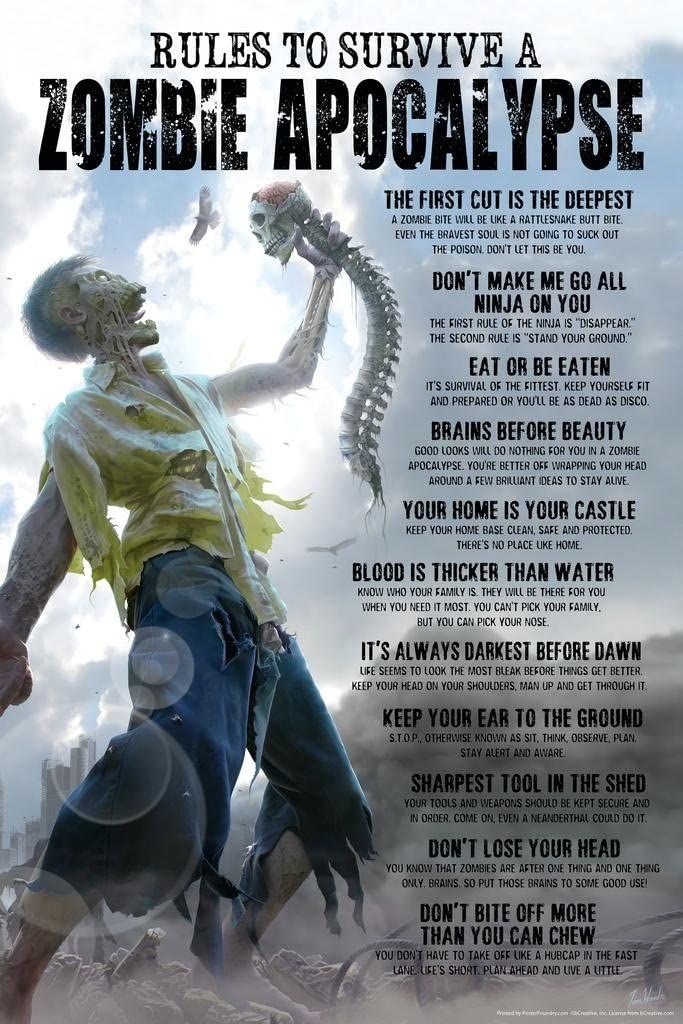

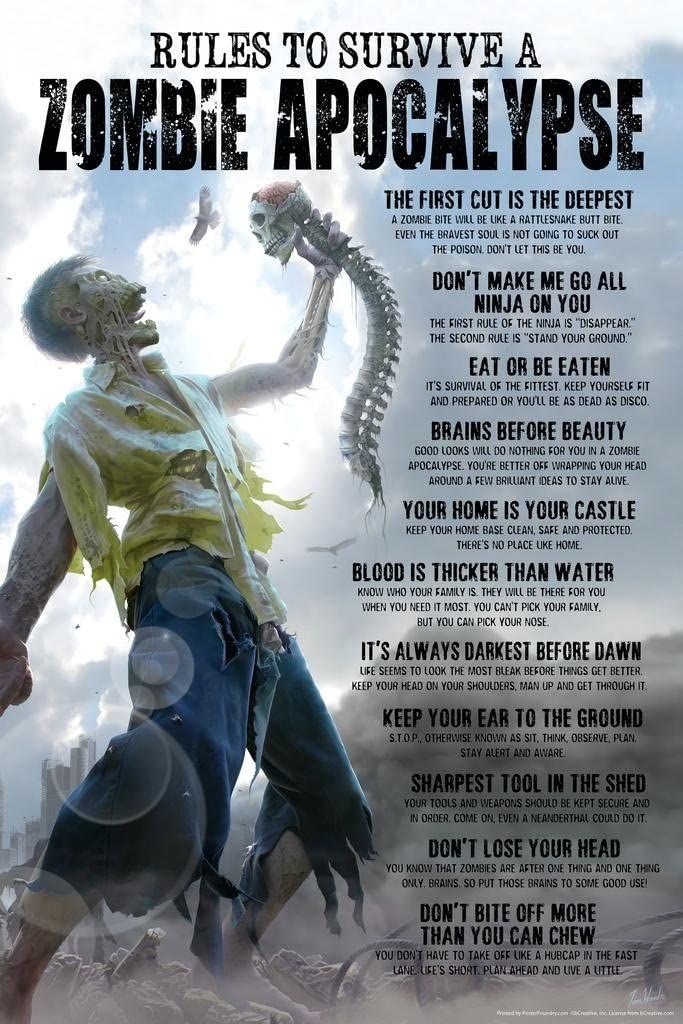

Yes, but: Just in case there is a zombie apocalypse this weekend, you’re lucky that Orlando holds the top spot as the best place to be for survival.

|

|

1 big thing: GDP grows in Q3

The Commerce Department reported yesterday that the US gross domestic product, a measure of the country’s output of goods and services, grew last quarter by 2.6% over the previous year.

Why it matters: One definition of a recession is that there are at least two consecutive quarters of GDP decline. So this latest news would mean that the US is technically not in a recession.

But, but, but, this is an election year, so almost every news story about the rising GDP focused on how this is the “calm before the storm” as “there are a number of signs that point to a broader slowdown” because fear doesn’t just get candy at Halloween; it also gets ratings.

-

There’s an old joke that economists have predicted 9 of the past three recessions. There is some truth in every jest.

-

While inflation is rising, employment numbers remain strong with Florida posting a recent unemployment rate of 2.5% which is insanely low historically.

-

While the housing market is slowing, clean energy jobs, consumer spending, and oil and gas exports are still strong.

Based on this, it’s a given that the Fed will raise interest rates at least 0.75% at its meeting next week, trying to slow down the economy and price instability (inflation). This means that mortgage interest rates will likewise rise along with credit card and car loan interest rates, slowing down consumer borrowing and consumption further.

On the flipside: Canada and other central banks are raising rates as well, but not as much as the US central bank is doing. It’s thought they may be slowing down to see if past rate increases have been sufficient.

What we're seeing: With the housing and mortgage markets slowing and other employment sectors growing, we’re not seeing multitudes of new real estate investors entering the market. Instead, many are leaving real estate behind to focus on W-2 jobs in other industries.

|

|

This is the last week that PCS Title will be taking orders for new real estate closings in Florida.

We opened in 2004 and really started running in 2005, surviving the Great Recession, carving out a niche handling closings primarily for real estate investors.

-

I’m going to shift our focus back to our real estate law practice and land trust services, with plans to expand those in the near future.

-

We will continue representing buyers, sellers, lenders, and brokers in real estate transactions. We will also advise business owners in sales and mergers, and we’ll form limited liability companies, including checkbook-control IRA LLCs.

-

Of course, we’ll continue drafting deeds and real estate documents for other law firms and title agencies, and our land trust services will continue.

-

Also, we will be able to continue handling closings in our law firm where no title insurance is issued, or complex commercial transactions with title insurance.

What's next: Pending closings will be transferred to other title agencies, and we will wrap up all operations by the end of 2022.

How do you prefer to receive information like the kind you receive in this weekly newsletter?

Your response is anonymous

|

|

|

-

FinCEN renewed and expanded the Geographic Targeting Order intended to prevent crooks from using shell companies to launder money through real estate transactions. ALTA

-

The Fifth District Court of Appeals held that the Consumer Financial Protection Bureau’s funding structure is unconstitutional. The CFPB has been under attack by the real estate title industry, payday lenders, and credit card issuers since it was created after the Great Recession in an attempt to prevent such a deep economic collapse from ever occurring again because of consumer abuses. This case will eventually wind its way to the US Supreme Court. NPR

-

Home sales numbers are partying like it’s 1996 when mortgage rates were over 8%. How low can you go? HousingWire (subscription)

-

The safest states to live have been ranked, and — spoiler alert — Florida definitely isn’t in the top 10. Wallethub

-

What to expect when adjusting a Hurricane Ian damage claim. JD Supra

|

|

Source: Amazon

In addition to living in Orlando, your next best bet to survive the apocalypse is to follow the rules on this poster available for purchase at Amazon.

This weekend, I’m sure we’re going to hear this song everywhere we go. Be sure to provide treats or suffer the tricks.

|

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Be on the lookout for our next issue! 👋

|

|

|

|

Was this edition useful?

Your responses are anonymous

|

|

|

Powered by

|

|

|