- Trust This.

- Posts

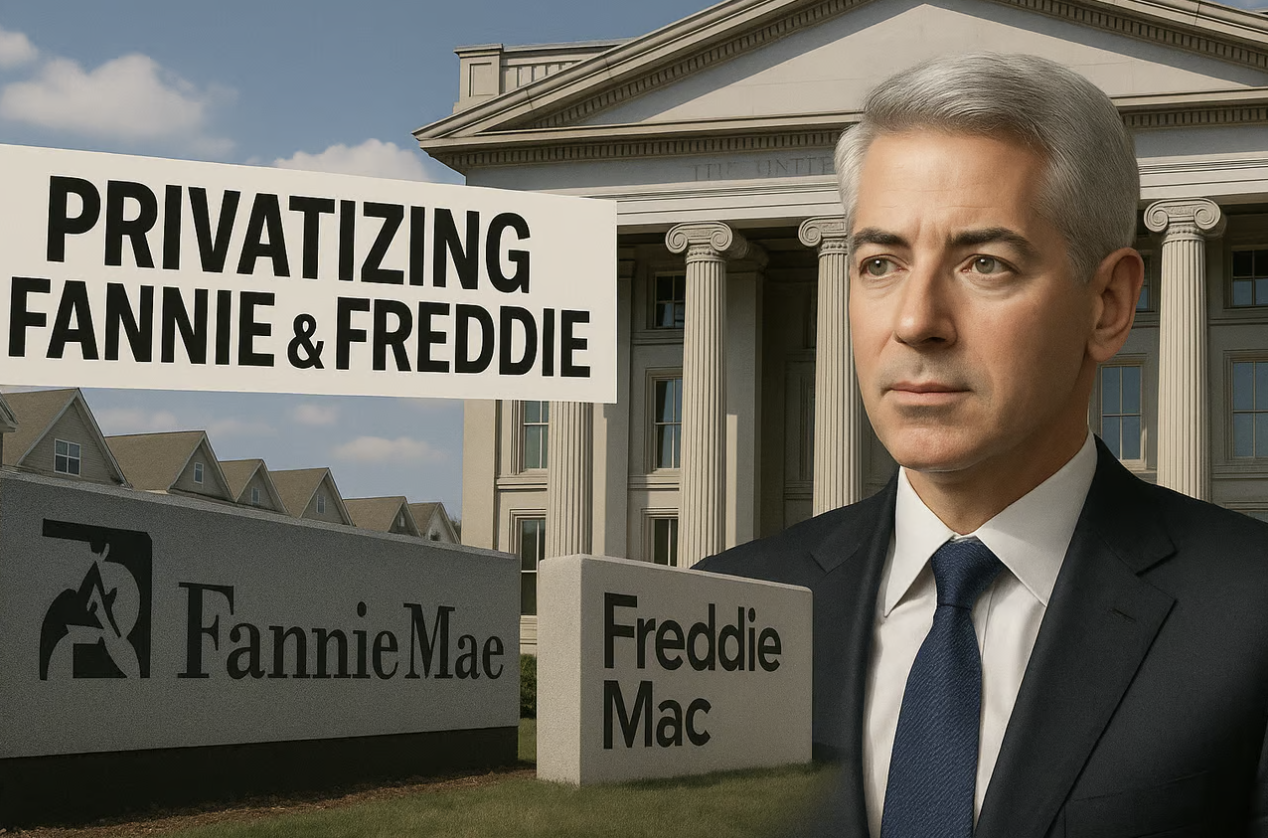

- 👋 Trust This: Privatizing Fannie & Freddie

👋 Trust This: Privatizing Fannie & Freddie

But if stagflation rears its head, the government may have to go even deeper on its bets in Fannie and Freddie that started in the last Great Recession

Trust This.

By Joseph E. Seagle, Esq.

👋 Happy Friday! Today is 🌳 Arbor Day. While the best time to plant a tree was 30 years ago, the next-best time to plant a tree is today. Or, as Warren Buffet is quoted as saying, "the tree you plant today provides the shade for tomorrow."

❗️Situation Awareness: U.S. tax returns and Florida corporate and LLC anual reports are due May 1 for those residing in Florida.

1 big thing: Privatizing Fannie & Freddie

🏛️ The Big Picture: Fannie Mae and Freddie Mac have been in federal conservatorship since 2008, a move triggered by the housing market collapse that rendered them insolvent. The Federal Housing Finance Agency (FHFA) took over management, backed by a U.S. Treasury lifeline through Senior Preferred Stock Purchase Agreements. Despite returning to profitability, the two government-sponsored enterprises (GSEs) have remained under tight federal control for over 16 years .

Now, investor Bill Ackman is proposing a dramatic exit strategy — one that could bypass Congress and reshape the U.S. mortgage landscape.

📜 Why They Went Into Conservatorship: The 2008 financial crisis exposed massive risk and undercapitalization at Fannie and Freddie. In response, FHFA (currently headed by William Pulte) stepped in, and the Treasury injected $193 billion to keep them afloat. In exchange, the government gained sweeping control and future dividends — which now total over $310 billion paid back by the GSEs.

⏳ Why It’s Lasted So Long: Despite years of profits and reform, political inertia and fears of destabilizing the housing finance system have kept the GSEs in conservatorship. Regulators have been cautious, citing the need for adequate capital buffers and market stability before handing back the reins. It also hasn’t hurt that the profits have been going to the U.S. Treasury as general revenue since the conservatorship began.

💼 Ackman’s Exit Plan:

Ackman proposes a pathway to privatization without involving Congress:

Forgive the Treasury’s remaining preferred stake, arguing it’s already repaid with a solid ROI of 11.6%.

Lower capital requirements to 2.5% from the current 4.25%, freeing up capital and avoiding rate hikes.

Launch staggered IPOs — Fannie in 2026 ($5B), Freddie in 2027 ($15B).

Maintain government support through 25 basis point credit guarantee fees, preserving a form of backstop

💡 What This Means for You:

Realtors & Mortgage Brokers:

Lower capital requirements mean no G-fee hikes, keeping mortgage rates stable.

A privatized, streamlined Fannie and Freddie could lead to faster loan approvals and greater product innovation.

Title Insurance Agents:

Market certainty around mortgage-backed securities could reduce transaction delays and increase closing volume.

However, the risk remains that perceived instability in privatized GSEs could spook investors, especially without full faith in a government backstop.

💰 Impact on the Treasury:

The U.S. government retains 79.9% warrant rights in both firms — a potential windfall if stocks rise.

Forgiving billions of dollars in value might spark a political backlash, especially in an election year.

The Bottom Line: Ackman’s plan revives the conversation around ending a decade-plus conservatorship. If successful, it could usher in a new era of private-market flexibility while preserving taxpayer protections — but only if trust in the system holds.

Go Deeper: HousingWire

2. Housing faces a stagflation storm

🏠 As stagflation looms in 2025, real estate professionals—agents, brokers, and investors—must navigate a market marked by high inflation, stagnant growth, and rising interest rates.

📉 The Big Picture: Stagflation, a rare economic condition combining inflation and economic stagnation, is impacting the housing market. Mortgage rates are climbing, consumer confidence is waning, and affordability is at a low point. This scenario is reminiscent of the 1970s housing downturn.

💸 Key Impacts

Mortgage Rates: 30-year fixed rates have surged past 6.5%, reducing buyer purchasing power.

Home Prices: Prices are softening in many markets, with some areas experiencing declines of up to 10%.

Investor Caution: Real estate investors are reevaluating portfolios, focusing on cash flow over appreciation.

Property Taxes: Inflation-driven property assessments are increasing tax burdens, squeezing margins.

Insurance Rates: As inflation increases the prices of construction materials, insurance premiums will also need to rise to keep pace, ensuring that claims payments adequately cover the cost of repairs.

🧭 Strategic Moves

Realtors: Educate clients on market shifts; emphasize long-term value over short-term gains.

Mortgage Brokers: Offer adjustable-rate mortgages and other flexible financing options to attract rate-sensitive buyers.

Title Agents: Streamline closing processes to reduce transaction costs and delays. Also, guard against contract cancellations, avoiding unnecessary work that requires more labor costs; consider collecting costs for surveys, title searches, and municipal lien searches up front from buyers and sellers.

🔍 What to Watch

Policy Changes: Potential government interventions, such as housing subsidies or interest rate adjustments, could alter market dynamics.

Economic Indicators: Monitor inflation rates, employment data, and consumer spending for signs of economic recovery or further decline.

📌 Bottom Line: Stagflation presents challenges for the housing market, but with informed strategies and adaptability, real estate professionals can navigate this complex landscape.

Go Deeper: Bigger Pockets; Realtor; Times; Norda Real Estate; NewsWeek

This week Al Nicoletti and I sat down to chat about probate issues for real estate investors. Listen in on a couple of lawyers discussing all the probate profits and pitfalls.

3. Catch up fast

Wanted: Central Florida contractor for defrauding elderly woman out of $300K. Daytona Beach News-Journal

The latest update on Homevestors. Propublica

The top-5 profitable short-term rental markets. Bigger Pockets

How will the Trump Tariffs and Deportations affect the housing market? Bankrate

Mortgage demand sinks 13% as rates soar. HousingWire

New home sales jumped in March, but how will Trump’s tariffs’ volatility affect it in the future. MPAMag

Rents fell slightly in March, but tariffs could make life harder for tenants. Redfin

How Gen Z will re-write the rules of homebuying. Cotality

Court stops mass firings at CFPB ABC News

The Sun Belt housing market’s slowdown is causing D.R. Horton Homes and other large home builders to pull back FastCompany

4. Closing Thought:

This quarter, we volunteered to inspect backpacks that will be part of the 25,000 backpack event for students of Orange County Public Schools in June. (L-R), Matt, Rick, Joe, Rachael, Mariana, Vanessa, and Jimmy.

🧠 The Big Idea: Psychologist and author Adam Grant once said: “Wisdom is not believing everything you think. Emotional intelligence is not internalizing everything you feel.” For real estate professionals and entrepreneurs, this insight is a game-changer—especially in high-stakes environments where emotions run hot, and quick decisions are critical.

📊 Why It Matters: In the world of deals, deadlines, and demanding clients, your ability to pause and question your own thoughts can mean the difference between a strategic win and a costly misstep. Emotional intelligence isn’t about suppressing emotions—it’s about managing them effectively. If you internalize every feeling—frustration, fear, anxiety—you risk burnout, bad communication, or blowing up your team culture.

💡 What You Can Do:

Challenge Your Thoughts: When you catch yourself thinking “This deal is falling apart,” or “I’m a terrible negotiator,” ask: Is that true? Flip the script by looking at the evidence and considering alternatives.

Label Emotions, Don’t Absorb Them: When you feel overwhelmed, say to yourself: “I’m noticing anxiety.” This subtle shift gives you space to respond, not react.

Create a Feedback Loop: Surround yourself with people who will challenge your thinking—not just echo it. Wise leaders invite pushback.

📈 The Bottom Line: Grant’s quote is a reminder that high performance isn’t just about hustle—it’s about mental clarity and emotional maturity. In real estate and business, your mindset can close (or kill) the deal. Don’t believe every thought. Don’t become every feeling.

🛠️ Try This: Start your week with a “Thought Audit.” Write down 3 thoughts or feelings that are clouding your judgment. Next to each, write an alternative interpretation. You’ll be surprised how much lighter—and sharper—you feel.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Was this email forwarded to you? Subscribe here.

Have an idea or issue to share? Email us.

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋

Reply

Keep reading

🚰 CFPB: Ya' never miss the water til it's gone

"CFPB RIP" -- Elon Musk on X/Twitter

🌊 Trust This: Insurance regulators clash

But it doesn't solve the bigger issues facing Florida's insurance market

⛔️ FinCEN BOI Reports

File 'em if they're foreign