Some of our readers may know that, over the years, we have founded a land trust company, a couple of law firms, and a (now closed) residential title insurance agency.

In 2005, along with another title agent, Philip and I also launched a second title insurance agency, PCS Holdings, LLC, formerly branded as “CloseMyTimeshare.com,” that focused on title insurance and foreclosures for some of the timeshare industry’s largest developers in Florida, Georgia, South Carolina, North Carolina, Virginia, Maryland, Tennessee, Texas, the Virgin Islands, and the Bahamas, via offices located in Orlando, FL; Richmond, VA; San Antonio, TX; and Charleston, SC.

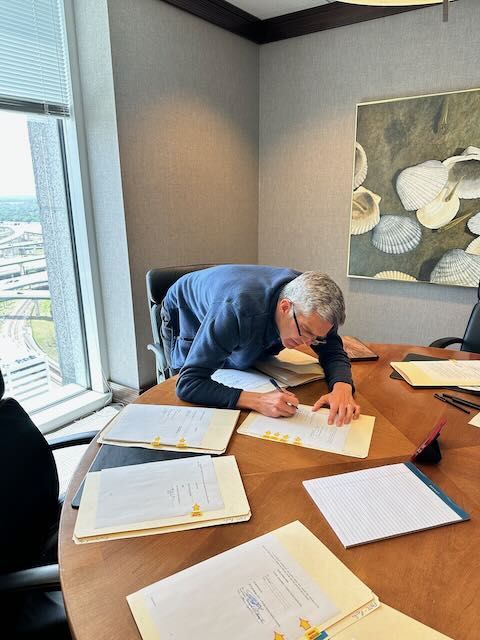

State of play: This week, we sold that company to Vacation Ownership Title Agency, Inc., with offices in South Florida, Nevada, California, and Hawaii. VOTA, together with PCS Holdings, is an affliliate of First National Trustee Company of America, a part of IQ-EQ.

What's next: While Philip and all other employees will remain with the company as it grows into its next phase, I will be — at most — an adviser or consultant for the company here and there as needed, freeing my time to pursue my next career journey. Be sure to read next week’s newsletter to see what that is ….

When we returned to the office after the signing, the crew greeted us with confetti bombs and streamers. They were blasting — as much as one can — music from their desktop computer speakers.

The bottom line: It was a momentous day for all of us, and we can’t thank our crew members, families, friends, advisers, and customers enough for everything they give back to us each day.