|

|

|

|

Trust This.

By Joseph E. Seagle, Esq. ● Nov 11, 2022

Smart Brevity® count: 4 mins...1100 words

👋 Hello and Happy Veteran’s Day! 🎖️ Please join us all in celebrating this day set aside to honor America's veterans for their patriotism, love of country, and willingness to serve and sacrifice for the common good.

|

|

1 big thing: Up but not much

October’s Consumer Price Index numbers came out this week, and prices are higher, but not as high as initially projected.

Why it matters: If inflation is slowing, then the Fed may lay off from raising interest rates as high and fast as they have been doing.

-

The stock market rose over 1,200 points on the news.

-

The S&P 500 had its biggest one-day increase since 2020.

Yes, but: China announced less onerous coronavirus restrictions and other indicators point to their economy rebounding. This means that more oil will be needed to fuel that growth, so oil prices increased a bit in anticipation of that greater demand.

-

But the big news for those in the housing industry is that the 10-year yield on Treasury Bills fell, meaning that mortgage interest rates will likewise fall.

-

The average 30-year fixed mortgage rate, the most popular one with new home buyers, dropped from 7.37% to 6.67% on the news.

What they’re saying: Logan Mohtashami, writing for HousingWire, points out that the biggest driver of core inflation is shelter (housing), and that sector’s data lags other inflation data out there.

-

Because it lags, the Fed can’t take it into account when deciding when to raise rates in an attempt to lower inflation.

-

As housing supply increases, days on the market increase, and prices decrease, that data will flow through to the CPI core inflation number.

The bottom line: Signs are out there that the Fed may give more weight to the housing market data the next time it sets its rates and may not raise them as high as anticipated. If that occurs, then a recession — if it occurs — should be a soft and short one.

|

|

FTX, one of the world’s largest cryptocurrency exchanges, collapsed this week.

Why it matters: Other crypto exchanges could end up in the same shape as this collapse pulls down all other cryptocurrencies.

The exchange suffered what would be called a “run on the bank” in the old days of physical currency when investors tried to cash out $8 billion of their holdings from the exchange, and there wasn’t enough to cover it.

-

The founder of the exchange, once-crypto-golden-boy Sam Bankman-Fried (AKA “SBF”), said that the exchange needed at least $4 billion to remain solvent or it would file bankruptcy.

-

Another exchange, Binance, offered to step in and rescue FTX. But Binance backed out, realizing it was too far gone to save.

SBF was once worth $26 billion and is one of the early magnates of the crypto world. I recall interviews with him at the company’s Bahamian headquarters, where he confidently talked of crypto’s future of replacing physical governmental currency.

-

This week, as FTX was collapsing, he told investors in a call that “I f—ed up,” and he would be “incredibly, unbelievably grateful” if they would help save the exchange.

-

Investors with cryptocurrency holdings in the exchange have been unable to sell or withdraw those holdings since early this week.

-

Celcius and Voyager are two other cryptocurrency firms that declared bankruptcy in the past, tying up their customers in bankruptcy court, trying to get their money back.

-

Bitcoin is down 75% from its one-time high.

Our thought bubble: Cryptocurrency is largely unregulated much like timeshares were in the 1970s and early 1980s. The timeshare industry learned that submitting to governmental regulation helped consumers have confidence in their purchases. Until the crypto industry has a similar awakening, consumers will be reluctant to put their real money into digital currency.

|

|

-

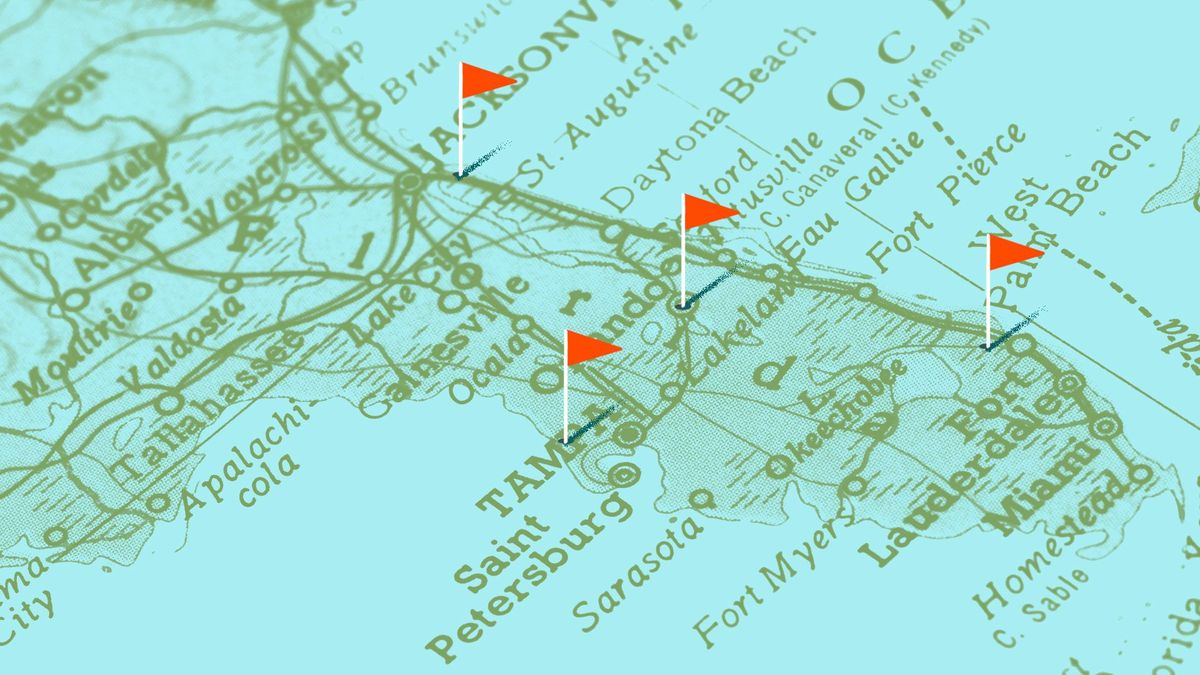

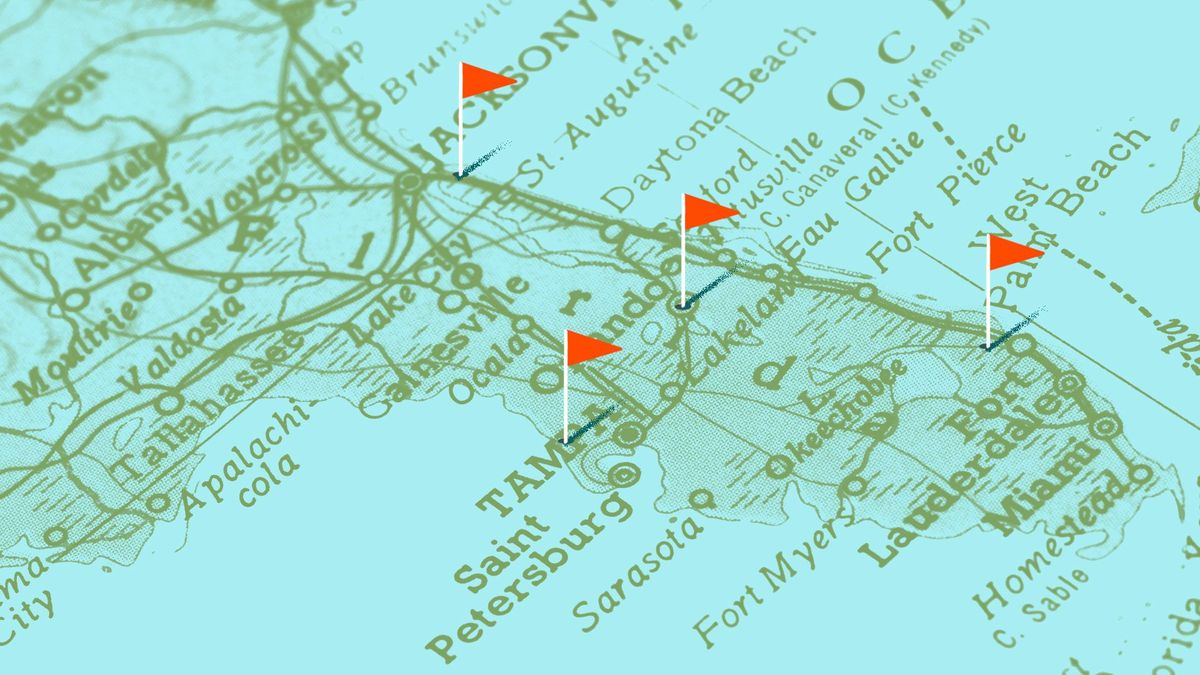

The 2022 midterm elections are in the bag, finally, and Florida turned a deeper shade of red. All eyes are on what Florida’s Republicans, with total control of all three branches of state government, will do about affordable housing, inflation, supply chain bottlenecks, labor shortages, public schools and universities funding, and — of course — skyrocketing insurance rates. Will they address these issues, or will they focus on culture wars and a presidential campaign? Tampa Bay Times (subscription)

-

Orlando home sellers are offering to pay buyers’ closing costs or buy down their mortgage interest rates to get buyers in the door. Buyers are demanding turn-key perfect homes at much lower prices. But are sellers panicking while buyers are being too demanding too early? Home prices are still high; homes on the market are still selling about 25 days faster than they were in 2019, and interest rates are still lower than they were just 10 years ago. Orlando Sentinel (subscription)

-

On the flipside, the housing market may be worse than we think as we move forward with rising rents and vacancies, higher home prices, higher mortgage rates, homes on the market longer, and buyers and sellers waiting for a change for the better. New York Times (subscription)

-

The middle class has enjoyed a wealth boom over the last five years as their home values and retirement accounts increased, plus governmental policies like the expanded child tax credit helped cushion costs of living. Now, however, will inflation and its cure — unemployment — bring the good times to an end? Bloomberg (subscription)

-

Renters vote at significantly lower rates than homeowners, but the gap is shrinking. The MReport

|

|

Jana Banana speaks to the breakfast attendees

I was fortunate to be invited to attend an executive breakfast for Chair The Love, a charity that provides wheelchairs for those who need them. The charity is proof that a small group of volunteers (5 to 6 people) working together with their community can have a hugely positive impact on thousands of children and adults around the world who need wheelchairs for mobility.

Big impact: If you’re looking for an effective charity with a global reach where you can be present as your charitable gift materializes in a wheelchair being given to someone from Peru or Puerto Vallarta, this organization deserves your consideration.

|

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Be on the lookout for our next issue! 👋

|

|

|

|

Was this edition useful?

Your responses are anonymous

|

|

|

Powered by

|

|

|