1 big thing: Homeowner Equity is Rising

In the first quarter of 2024, homeowners with mortgages saw their equity increase nearly 10% over the last 12 months — or $1.5 trillion (with a “T’).

Why it matters: More homeowners with more significant home equity means far more options for selling and buying new properties.

Homeowner gains: The average U.S. homeowner gained $28,000 in equity over the past year.

California: $64,000, with the Los Angeles metro area netting $72,000

Massachusetts: $61,000

New Jersey: $59,000

No states posted equity losses.

Home equity is key to mortgage holders who have seen other homeownership costs soar, including insurance, taxes, and HOA fees.

Good equity is up, negative equity is down: One of the measures used in developing the CoreLogic Homeowner Equity Insights report is negative equity, which occurs when borrowers owe more on their mortgages than their home is worth as happened often in 2008 through 2012. Compared to the first quarter of 2023:

The total number of mortgaged residential properties with negative equity decreased by 16.1%.

This represents 1.2 million homes or 2.1% of all mortgaged properties

A desert city takes the win: Las Vegas, Nevada, is the least underwater city in the U.S., with the lowest negative equity share of all mortgages at 0.6%. This is a big shift from the Great Recession when it was a metro with one of the highest levels of negative equity and foreclosures. In line behind Vegas are:

Los Angeles: 0.7%

San Francisco: 0.8%

Miami: 0.9%

Boston: 1.2%

Keep an eye on home prices: If they continue to rise, then even more homeowners will move out of negative equity.

Projections are for a 3.7% increase through March 2025.

Low negative equity is important in markets with declining prices since as prices drop, equity may also drop.

The bottom line: More equity means more options for homeowners in the markets noted above, who could use professional guidance to leverage their equity.

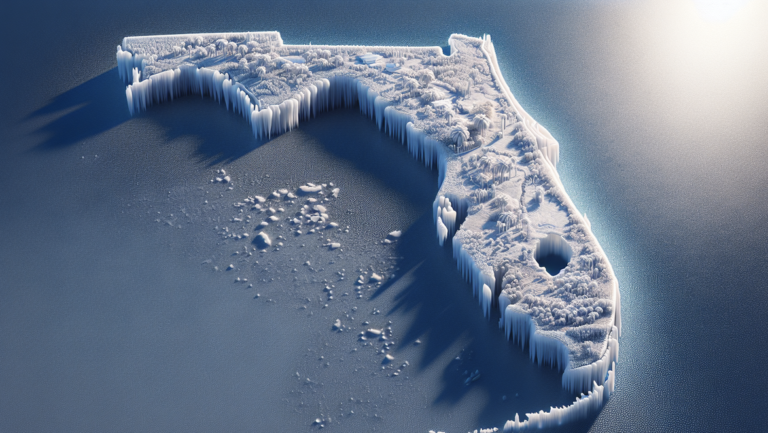

2. A Cool-Down in Western Florida

The fastest cooling housing market in the United States is western Florida, according to Redfin.

Why it matters: The pandemic-era homebuying boom is ending as inventory soars and prices continue to drop, leaving western Florida feeling awfully chilly this summer. The fasting cooling Florida markets are in:

North Port

Tampa

Cape Coral

The rest of Florida isn’t far behind: Among the ten markets cooling the fastest, three other Florida metros make the list:

Orlando

Jacksonville

Lakeland

In case you’re interested, the other 4 markets in the too-cool-for-school top 10 are:

Denver

Houston

Minneapolis

Dallas

The thermometer: Redfin uses the following factors to take the market’s temperature:

Year-over-year changes in home prices

Price drops

Inventory

Sale-to-list price ratio

Share of homes that sell within two weeks

So why Florida? One of the biggest reasons for the cool-down in the western Florida housing market is that natural disasters send buyers elsewhere, even as inventory rises.

NOAA predicts the 2024 hurricane season will be BIG.

Additional factors: A significant construction boom in Florida is also contributing to the cooling. Plus, like everywhere, the pandemic-era homebuying binge is a thing of the past.

We’re in a buyer’s market now: Buyers who do choose the western Florida market can be choosier, because—

Inventory is up!

In North Port, it’s up 68% year-over-year

In Cape Coral, it’s up 64% year-over-year

And prices are down:

Overall, 43% of sellers are dropping asking prices compared to last year’s 36%.

In Cape Coral, 37.5% are dropping their price compared to last year’s 32.9%.

Compare western New York and Midwest: These markets are holding up the best.

The typical home in Rochester, NY, and Buffalo, NY, sells for $250,000. New York City metro area homes sell for three times that much.

The bottom line: Western Florida may be sizzling in the summer heat, but the housing market is on ice.

3. Catch up fast

9 hot spots where investors can still find affordable short-term rental properties. BiggerPockets

Comparing 2011’s housing market to today’s. HousingWire

Vacant land deals and their challenges. MPAMag

A summary of all the new 2024 Florida laws affecting real estate. The Fund

NAR supports Biden’s policies to expand housing affordability. NAR

Analysts weigh in on their thoughts about what the DOJ’s endgame is in the commission settlement lawsuit. HousingWire

Supreme Court Ruling jeopardizes scores of consumer protections. Consumer Reports

4. Closing Thought

The recent Supreme Court decision in the Loper Bright case is set to reshape the regulatory landscape for the next 40 years, significantly affecting real estate professionals, business owners, and consumers.

Why it matters: The Court overruled a 1984 case (Chevron v National Resources Defense Council) cited in over 18,000 cases as courts examined federal agencies’ interpretations of Congressionally passed laws under a test known as the “Chevron Doctrine” for the past 40 years.

Background: Loper Bright Enterprises v. Raimondo involved commercial fishermen challenging a federal mandate requiring them to pay for onboard observers.

The cost was $710 per day and the National Marine Fisheries Service reimbursed the fisherman for the cost of the observers until the Service ran out of funds and terminated the program in 2023.

The Chevron Doctrine: Established in 1984, the Chevron Doctrine mandated courts to defer to federal agencies’ interpretations of ambiguous laws, provided those interpretations were reasonable. This doctrine empowered agencies like the EPA, the Department of Transportation, and the Department of Treasury to enforce regulations with expert knowledge and relative non-partisan, apolitical autonomy.

The Shift: The Supreme Court’s 6-2 (Justice Jackson recused) decision in Loper Bright revoked this deference with significant changes, asserting that courts, not federal agencies, should interpret congressional intent.

The big picture: This decision marks a significant shift, placing the judiciary at the forefront of interpreting regulations and reducing the power and influence of federal agencies.

Implications for Real Estate:

Regulatory Uncertainty: Real estate professionals should brace for regulatory uncertainty. Federal regulations impacting environmental standards, land use, and financial reporting may now face prolonged judicial review.

Increased Litigation: The real estate industry might see a surge in legal challenges against federal regulations, leading to potential delays in projects and increased legal costs.

Compliance Challenges: With courts reassessing agency rules, compliance with existing regulations could become more complex and inconsistent, requiring small businesses to stay vigilant and adaptable.

The bottom line: The Supreme Court’s ruling fundamentally alters the balance of regulatory power, posing new challenges and uncertainties for the real estate industry. Staying informed and proactive is crucial for mitigating risks and adapting to this new legal landscape.

What’s next: Don’t be surprised to see FinCEN’s proposed rules regarding reporting of all non-bank-financed entity real estate transactions sputter to a halt, along with more challenges arising from the current BOI reporting requirements.

Go deeper: ScotusBlog

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Was this email forwarded to you? Subscribe here.

Have an idea or issue to share? Email us.

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋