1 big thing: RealPage Faces Class Action Lawsuits and FBI Raids

Rent-setting software from RealPage could contribute to skyrocketing rental prices nationwide, as we’ve written before.

Why it matters: Today’s rents are eye-wateringly high.

-

Sure, inflation plays a role in that.

-

However, the FBI and plaintiffs in several class action lawsuits see the dark forces of collusion at work even more.

-

Rental rates have outpaced other inflation indicators by 40.7% over the last ten years.

-

One software company driving deepening social inequality across the U.S.? It sounds dramatic, but RealPage isn’t creating fair and competitive markets.

Correlation isn’t causation, but rents in the U.S. have risen nearly 200% since RealPage entered the market.

How it works: Landlords feed data about current rental prices, occupancy rates, lease terms, and amenities into the program. RealPage suggests a rate increase.

-

Landlords accept the suggestion 80-90% of the time, a 2022 ProPublica investigation found.

-

Arizona Attorney General Kris Mayes says this isn’t competition. The landlords “were colluding with one another” via the algorithm.

Landlords love it: The country has an estimated 40-50 million apartment rental units. RealPage calculated the monthly rate for 16 million of them.

-

In DC, RealPage sets the rate for 60% of the city’s rentals. In Phoenix, it affects 70% of rentals.

-

In Atlanta, where rental prices have increased 80% since 2016, RealPage sets the rate for 80% of properties.

Hmm. Yes. Hmm.

-

What they’re saying: RealPage’s Andrew Bowen said this when asked about the software’s role in surging rental prices: “I think it’s driving it, quite honestly.”

-

In May, the FBI raided the offices of Cortland Management, an owner and manager of apartment communities across the USA, as part of a larger DOJ antitrust investigation.

-

Meanwhile, lawsuits accusing RealPage of collusion were initiated in New York, Arizona, California, and other states.

The bottom line: RealPage’s software may have significantly shaped the rental market—to the detriment of renters. Investors, landlords, and real estate professionals should monitor the unfolding legal developments and potential regulatory changes.

Yes, but: If the cases go to the Supreme Court, we’ll see if Justice Clarence Thomas recuses himself.

-

Why? Because RealPage is at least partially owned by the billionaire Harlan Crow.

-

Mr. Crow has paid for Justice Thomas’s $250K+ RV, his nephew’s private school education, his mother’s house, and regularly takes the justice and his wife on far-flung exotic vacations on private jets and yachts.

-

It will be interesting to see if the justice stays silent the next time his benefactor stands before the court. If the past is an indicator, he’ll write an opinion in favor of his friend.

2. Newly Built Apartments Sit Vacant

As of Q4 2023, less than half of newly constructed apartments were rented out within three months. This is the lowest seasonally adjusted share on record for this metric since the pandemic and surprising given our nationwide housing crunch.

What it means: According to Redfin, market saturation is behind the slowdown. If this is the case, property owners will soon find themselves competing (aggressively) for tenants.

-

For renters: This could mean some much-needed relief from higher rents.

-

For landlords and investors: ROIs are likely to dip or stay flat.

Hitting the brakes:

-

Q4 2022: 60% of new apartments were rented within three months of construction.

-

Q4 2023: 47% of new apartments were rented within three months of construction.

Also, in Q4 2023, more than 90,000 new apartments were completed, the second-highest number of new builds since 2012.

-

Brand-new project starts have slowed so far in 2024, but the completion rate has been high as a backlog of pandemic-era projects finally closed out.

Renters and landlords must make it work: With mortgage rates stubbornly lodged above 7% and vertiginous sales prices, demand for apartments remains high.

-

Rental rates still outpace worker income, though, with median-priced new-build apartments requiring an average annual income of at least $66,000.

-

Landlords with empty new apartments and renters struggling to afford them may have to come together to negotiate a mutually beneficial outcome — including concessions like discounted amenities or parking.

The bottom line: As an influx of new apartments continues to pour in, the competition for tenants could become even more fierce. Property owners eager to fill their spaces will need both flexibility and a nuanced understanding of local market conditions.

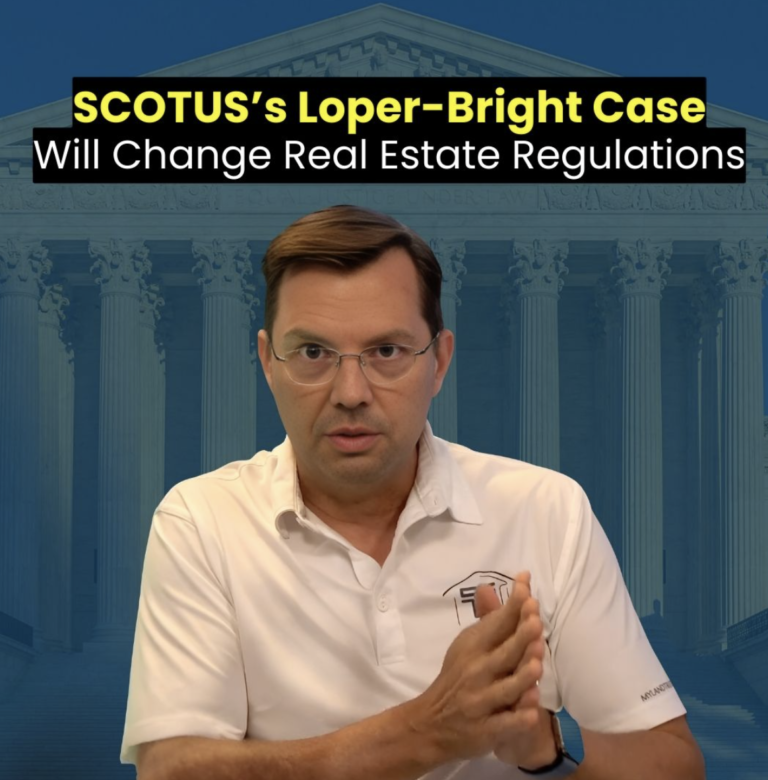

In this week’s podcast, I discuss the Supreme Court’s holding in the Loper Bright case I discussed in last week’s Trust This newsletter. I go a little more in-depth and give more examples of how it will affect everyone touched by federal regulations for the foreseeable future.

3. Catch up fast

-

The Florida Bar’s Real Property, Probate, and Trust Law Section filed comments opposing the proposed FinCEN GTO rule expansion to require registration of all non-human, non-bank-financed real estate transaction buyers and sellers. Florida Bar News

-

National Association of Home Builders testify before Congress, asking for it to support policies to increase affordable housing construction. WRE News

-

Inflation numbers cooled broadly to 3.0% year-over-year, with the smallest gain since August 2021, dragged down by cheaper gasoline. Some say that the Fed may cut its lending rate in September as this and other indicators show the cooling of the economy. Bloomberg (gift link for 7 days).

-

How is America’s fix-and-flip market doing? MPAMag

-

11 housing markets that were once hot but have now gone cold. Bigger Pockets

4. Closing Thought

“I am a …” can be a self-imposed prison cell on your mindset, or a way to break free.

Why it matters: Self-identification can open doors or lock us into rigid roles. Understanding this distinction is crucial for long-term success and personal fulfillment for small business entrepreneurs and real estate professionals.

Yes, but: There’s a common pitfall in defining ourselves.

-

I often say, “I’m a lawyer,” when asked about what I do.

-

However, this doesn’t convey the full scope of what I do, which involves helping real estate entrepreneurs and small business owners protect their assets and build generational wealth.

The big picture: This self-definition becomes a metaphorical prison, restricting our identities.

-

If I enjoyed running, I might start identifying as, “I’m a runner.”

-

While initially positive, this new label could become another restrictive identity, making it difficult to embrace change when necessary.

Between the lines: Lately, I’ve heard several stories of retirees who passed away shortly after retirement, attributing their decline to a loss of purpose.

-

Having heavily identified with their professional roles, they couldn’t adapt to a life without work — outside their definition of themselves.

-

They metaphorically died in a prison of their own making.

The bottom line: Adopting a broader perspective of self-identification is essential. Many professionals struggle to imagine life beyond their roles, which can make it challenging to retire or even take a break without feeling lost.

What to watch: Next time someone asks what you do, notice your response.

-

If you find yourself saying, “I am a [profession],” take a moment to reflect.

-

Consider the implications of what you’re saying, and start to look beyond the cell bars of that confining statement so you can move freely forward.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

-

Was this email forwarded to you? Subscribe here.

-

Have an idea or issue to share? Email us.

-

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

-

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

-

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋