|

|

|

|

Trust This.

By Joseph E. Seagle, Esq. ● Dec 16, 2022

Smart Brevity® count: 4 mins...1020 words

👋 Happy Friday! Fortunately, the weather has cooled 🌡️ in Orlando, so our participation in National Ugly Christmas 🎄 Sweater Day today is comforting, if not jarring.

|

|

1 big thing: Property insurance hopes and prayers

The Florida Legislature completed its second special session this year. New legislation prohibits assignments of benefits to contractors, provides a $1 billion taxpayer-funded reinsurance backstop, severely limits consumers’ ability to sue insurers who refuse to pay valid claims, and raises Citizens Property Insurance rates.

Why it matters: Florida has the highest property insurance rates in the nation, with increases averaging 33% this year. The Legislature did not include any requirements for insurance companies to reduce premiums or even hold premiums at current levels in exchange for these gifts to the industry.

I’ve written on this topic at least three times in the past nine months alone, underscoring how important the issue is for anyone who owns or sells Florida property. In case you missed those discussions, you can read them here, here, and here for background.

-

This latest special session, like previous ones, was scheduled to last a full week. Still, legislators arrived in Tallahassee, rubber-stamping the plan that the governor, working with house and senate leadership, had pre-packaged, so they could go home by Wednesday afternoon.

-

Public testimony in most committees was limited to one minute per citizen.

-

Democrats questioned how many “frivolous” consumer lawsuits against insurers had been dismissed under Florida’s frivolous litigation rules. They questioned the salaries of insurers’ C-Suite leadership. No data was sought, available, or provided.

-

Republicans limited Democrats’ time to debate the legislation to a total of 80 minutes out of the 48 hours overall to review, debate, and vote to pass it.

Democrats offered amendments requiring insurers who offer other insurance, such as automobile insurance, to provide real property hazard insurance too, so they can’t cherry-pick only the most profitable lines of insurance to provide in Florida. Other Democratic amendments would have:

-

required insurers who save money under the new legislation to cap rate hikes.

-

tied rate hikes to the Consumer Price Index.

-

subsidized premiums for low-income homeowners.

-

prohibited insurance executives from taking bonuses in years they raise rates.

Yes, but: The super-majority Republican conferences denied all of these proposed amendments, and their appointed Insurance Commissioner, David Altmaier, tendered his resignation to the governor yesterday, effective at the end of this month.

-

What’s next: Rates for Citizens Insurance policies will increase up to 50% in some places, and those covered by Citizens will be required to maintain a flood insurance policy as well, even if the property is not in a flood zone.

The bottom line: There will be hopes and prayers that the insurers, who received a lot of legislative gifts in this package, will allow those gifts to trickle down to consumers in the form of lower rates or that they at least will remain in business in the state.

Go deeper: There’s a LOT more in the legislation that space doesn’t permit here, but the Tampa Bay Times and Orlando Sentinel explain it well for their subscribers.

|

|

2. Falling inflation = falling mortgage rates?

Inflation slowed more quickly than expected in November. The Fed, in response to this news, increased its lending rate by only half a bps rather than the three-quarter bps increases it had been making for the past four announcements.

Why it matters: The slowdown may lead to a decrease in mortgage rates.

What they’re saying: Jerome Powell, when announcing the new rate increase, said that “the appropriate thing to do now is to move at a slower pace.”

-

The Fed set its target rate at 5.1% by the end of next year, instead of the 4.6% it had set in September as a target.

-

They expect to then start bringing the Fed rate down slowly, starting in 2024.

Mortgage rates have been coming down in the past few weeks from highs over 7% to 6.3% as of Tuesday this week.

-

Mortgage applications rose by 3.2% last week as borrowers grow more comfortable seeing a “6” as the first number of their interest rate.

-

Average rental rates are likewise expected to drop over the next year as leases written in boom times expire and are renewed at lower rates in a slower economy.

The bottom line: Mortgage rates are dropping though everyone knows that the Fed is going to continue raising its underlying borrowing rate. The latest Mortgage Bankers Association estimate pegs the average 30-year mortgage rate at 6.7% at the end of this year, but further estimates that it will end 2023 at 5.2%. With interest rates expected to drop along with home prices, buyers could start returning in healthy numbers next year.

|

|

-

Zillow released its list of the 10 best places for first-time homebuyers. No city in Florida is on the list. CNBC

-

Rent-burdened tenants, those paying more than 30% of their income towards rent, make up 40% of tenants nationwide on average. However, Florida’s percentage of rent-burdened tenants exceeds the average in most counties. See how yours fits into this statistic. Realtor dot com

-

Ever wonder how many hours a person must work on average to afford rent in the US? Zillow has the answer. Bigger Pockets

-

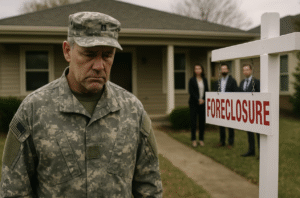

Around 250,000 people who bought homes this year now find their properties underwater, not worth as much as they owe. Fox Business and Dodd Frank Update

-

A Minneapolis house flipper was sentenced to 58 months in prison and ordered to pay over $1.6 million in resitution for defrauding her investors. The Legal Description

|

|

Our October Magic Ruby Camellia bush is bursting with color in December, thanks to the late arrival of cooler weather this year. There is a “Yuletide Camellia” as well, but we, unfortunately, don’t have any of those in our garden.

For some reason, seeing a Camellia this time of year made me think of Camila singing this song.

|

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Be on the lookout for our next issue! 👋

|

|

|

|

Was this edition useful?

Your responses are anonymous

|

|

|

Powered by

|

|

|