|

|

|

|

Trust This.

By Joseph E. Seagle, Esq. ● May 27, 2022

Smart Brevity® count: 3 mins...740 words

🇺🇸 Coming into this Memorial Day three-day weekend, we salute our veterans and others who have served with honor and sacrifice. 🇺🇸

|

|

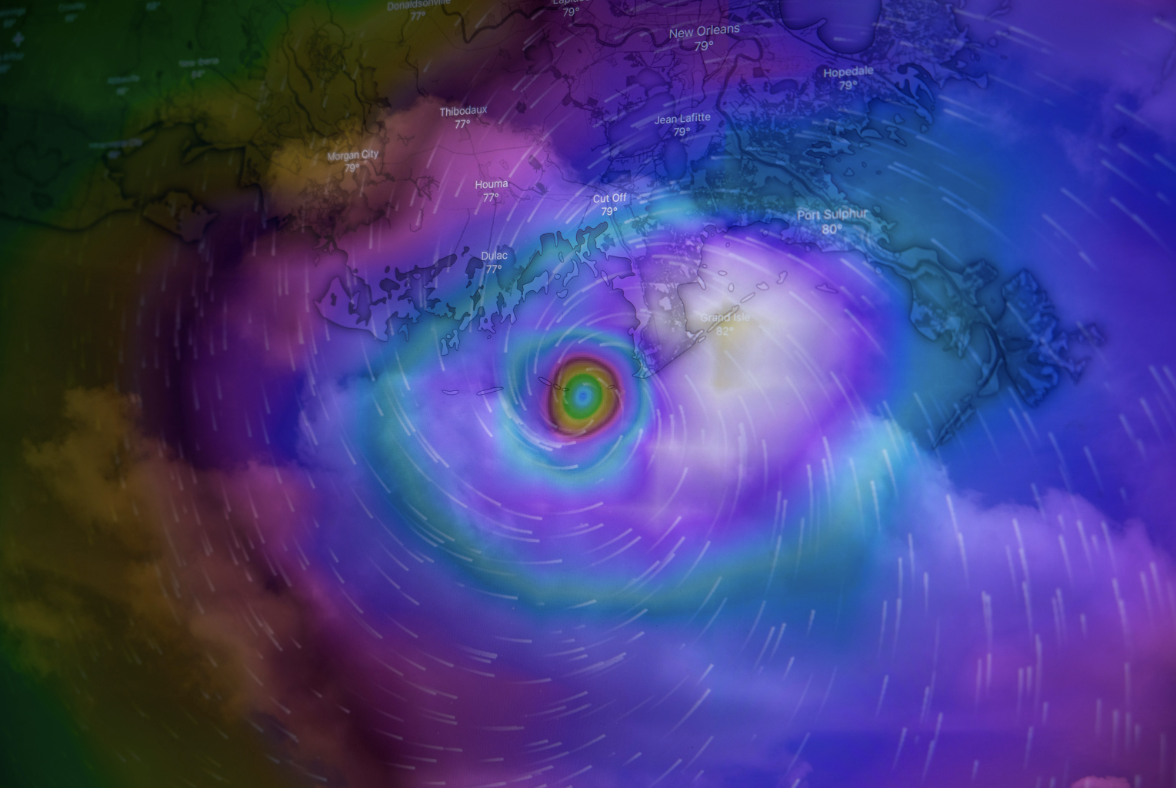

1. Big Deal: Insurance reforms

Five days before the start of Hurricane Season, the Florida Legislature raced through a three-day special session to pass statutory reforms tweaking homeowner’s insurance.

Why it matters: Since 2014, nine insurers fell into receivership; numerous others left the state. Those remaining have raised rates to the point that their policies are unaffordable, leaving homeowners scrambling to find affordable coverage this year.

What passed:

-

$2 billion was set aside to reimburse insurers for hurricane losses. Formerly they couldn’t tap these funds until they’ve paid out the maximum in claims. An amendment to require insurers to reduce premiums by 5% if they tap this fund was defeated.

-

Insurers can offer a 2% deductible for roof repairs or any replacement of 50% or more of the roof.

-

Provisions to make it harder to sue insurers for bad faith denial of property and casualty claims, and the lawyers bringing such suits will have their fees regulated and reduced.

-

Contractors must disclose that the homeowner is liable for roof repair deductibles, and it’s now a felony for the contractor to waive or pay the deductible for the homeowner.

-

Insurers cannot deny coverage if the roof is less than 15 years old, and must insure older roofs if they are proven to still be viable. Plus $150 million was set aside to help homeowners reinforce homes against hurricanes.

-

Nothing passed to guarantee lower rates for consumers.

Yes, but: The industry says it takes at least 18 months before reforms affect premiums, taking time for the changes to be implemented, written into new policies, and for actuaries to account for the revisions. Changes made in last year’s session regarding roof repair companies haven’t had much effect on this year’s premiums, so it will be interesting to see when/if these latest reforms take effect.

|

|

2. Last-minute add-on: Condo Regulation improvements

Florida’s Legislature unanimously passed condominium statutory revisions in a surprise move during the special session.

The Florida Bar, Association of REALTORs, architects, property managers, and engineers worked with condominium owners to address the deficiencies in Florida’s condo regulations, attempting to prevent another high-rise tower collapse. Their suggestions were conveyed to the Legislature.

What passed:

-

Not only for condos but if a roof constructed under the 2007 or later Building Code, must be repaired, then only the portion being repaired or replaced must be built under any newer code requirements.

-

Mandatory structural inspections for condos three stories or taller must be completed by December 31 of the building’s 30th year (25th year if located within 3 miles of the coast), and every 10 years thereafter.

-

Condos built prior to 1992 must complete such inspections by December 31, 2024.

-

The association must begin required repairs within 365 days of receiving the report.

-

All condos with structures three stories or higher must complete a structural integrity study by December 31, 2024.

-

Owners may no longer waive reserves for the repair or replacement of any structural integrity items: roof, electrical, plumbing, windows, and anything over $10,000.00 to replace.

The bottom line: It’s amazing what the legislature can accomplish when under a short deadline and when working on things that everyone can agree must be done.

|

|

See what I did there? Catch up / Ketchup?

Go deeper: Here are some stories from this past week that I found interesting:

-

Florida’s median home price increased to $410,000 in April, which is a 21.8% increase over the previous year. Those earning an hourly wage are priced out of the market at such prices. Orlando Sentinel - Subscribers only

-

Perhaps because prices are so high, and interest rates are likewise increasing, the housing market is showing signs of slowing down. Axios

-

Want to build a pool? Get in line. Florida had a 23% increase in pool permit applications in 2020 alone, with some parts on backorder for over a year. Orlando Sentinel - Subscribers only

-

What buyers and sellers should think about as the hot housing market shows signs of cracking. REALTOR

|

|

The drift roses are bursting out this year.

|

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Be on the lookout for our next issue! 👋

|

|

|

|

Was this edition useful?

Your responses are anonymous

|

|

|

Powered by

|

|

|