|

|

|

|

Trust This.

By Joseph E. Seagle, Esq. ● Aug 16, 2024

Smart Brevity® count: 5.5 mins…1489 words

👋 Happy Friday! In case you forgot, tomorrow, August 17, is the first deadline for implementing the National Association of REALTORs Settlement. Hang onto your hats; it’s about to get bumpy.

|

|

🚨 1 big thing: CFPB Kills Agreements for Deed

On Tuesday, the Consumer Financial Protection Bureau released an advisory opinion that effectively regulates Contracts For Deed out of existence.

Why it matters: Many real estate investors rely on the contract for deed, agreement for deed, installment land contract, land contract, or bond for deed to exit a property.

Investors who purchase a property subject to the seller’s mortgage will often sell the property to an end buyer on an agreement for deed.

-

Under common law, the title remained with the seller until the buyer paid the seller the total purchase price outlined in their agreement.

-

Upon payment in full, the seller would execute and record a deed from the seller to the purchaser.

-

They have financing terms at interest rates higher than market rates because the buyers aren’t creditworthy to obtain traditional financing and are thus at a higher risk of default.

-

Usually amortized over 15 to 30 years, they require a balloon payment in three to five years.

Yes, but Florida, South Carolina, North Carolina, and many other states treat such agreements the same as notes and mortgages, requiring a foreclosure action to be filed in court to enforce them in default.

What they’re saying: CFPB held a hearing in Minneapolis to unveil its new advisory opinion. According to the speakers:

-

Contracts for deed have blossomed in use among the Somali population there.

-

Somali culture, as in some other cultures, prohibits the charging of interest, so the contract for deed — unlike a promissory note — may be written in a way that circumvents interest.

-

However, they’ve been abused by sellers who take advantage of buyers by offering onerous terms they know the buyer-borrower can never fulfill.

State of play: The Dodd-Frank Act of 2010 still exempts at least the first seller-financing transaction a seller completes in a calendar year from the Truth-in-Lending Act and RESPA Regulation Z requirements.

-

This new advisory opinion clarifies that contracts for deed are not “seller-financing” under Dodd-Frank because the title remains (at least in Minnesota) with the seller.

-

They are consumer finance transactions that are subject to the Acts.

-

A seller may still do one seller-financed transaction a year and remain exempt from TILA regulations.

-

A seller who extends credit through multiple subsidiaries or entities is still a “creditor” exceeding the 1-time-a-year exemption.

-

So using different land trusts or LLC’s to do seller financing of any type more than once a year subjects the owner of the LLC or land trust to TILA and Reg. Z.

The bottom line: Contracts for deed are no longer legally safe to use as an exit strategy. Even when they are the first or only seller-financing mechanism that year, they are subject to TILA and Reg Z.

What’s next: Lease-options and traditional notes and mortgages will become the exclusively used seller-financing exit strategies from now on … unless courts strike down the CFPB’s interpretation of “consumer loan” vs. “seller-financing” using the new powers gathered unto it under its Loper Bright opinion.

|

|

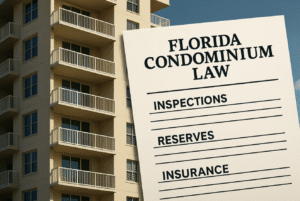

2. Florida Condo Market Experiencing Double Whammy

Rising insurance costs and a rash of milestone inspections have created a perfect storm for Florida’s condo market.

Why it matters: Condos continue to be a risky investment. This could hinder sales for current owners but— with the right precautions — could also mean it’s a good time to buy.

The legislative background: In late 2022, in response to the Surfside condo collapse the year before, the Florida Legislature passed the Condo Safety Act, which:

-

Allows condo associations to levy social assessments on unit owners on top of their usual monthly homeowners association dues

-

Requires condos to undergo a “milestone inspection” if they’re either at least 30 years old —or— 25 years old + within 3 miles of the coast

-

Prohibits condos from waiving funding reserves for building components that are critical to structural soundness

Insurance hurdles: Master insurance plans are running 100% to 500% more a year, a cost that is passed on to condo owners. The industry’s in good financial shape:

Buyer’s market: Year over year, inventory has gone from a three-month supply to at least a six-month supply.

-

From July 2023 to July 2024, the 90-day average has jumped from 2,926 to 5,623.

-

90-day median time: Year over year, the time a condo property sits on the market has gone from 49 days to 70.

Florida condo buyers can protect themselves by:

-

Reviewing 12 months of board minutes prior to purchase, looking for discussions of special assessments, major repairs, and budget reserves;

-

Analyzing milestone inspection reports and reserve studies;

-

Speaking to board members and other community members to ensure nothing is missing from the seller disclosures.

The bottom line: As trustees, we’re receiving notices almost daily from associations that are having to take out multi-million-dollar loans to cover major structural repairs, notices of large special assessments, and budgets with major increases. If buying or selling a condo, ensure disclosures are complete and truthful as the market’s sands shift quickly under your feet.

|

|

Speaking of seller financing, this week’s “Ask Joe” episode of the Trust This podcast is about handling defaults when your borrower stops paying.

Listen in or watch on your favorite streaming platform.

|

|

3. Catch up fast

-

What’s about to change for buyers and sellers of homes under the NAR settlement. Time via Apple News

-

FTC to refund $12 million consumers who were victims of a house-flipping coaching program scheme. WRE News

-

14 cities with the highest risk of storm damage this hurricane season (and only four are in Florida). Bigger Pockets

-

Opinion – The Fed is too late to save the housing market this year. Bloomberg (gift link good for 7 days only)

-

New houses now cost less per-square-foot on average than existing older homes. Axios

|

|

4. Closing Thought: Your role is not your identity

Edward’s advice for the week: Now and then, just stop chasing balls, smell the lantana, and watch a butterfly or two while doing it. Photo: Joe Seagle

Many entrepreneurs’ and business leaders’ professional roles are intertwined with their identities.

-

After years of dedicating themselves to building a company or managing a team, it’s easy to see why.

-

However, as retirement approaches, this identity can feel like it’s slipping away, leaving many unsure of who they are without their job.

Why It Matters: Your role is not your identity.

Yes, but: The transition from being a key player in the business world to retirement can be challenging.

-

Many individuals fear losing their sense of purpose and relevance.

-

This fear often stems from the misconception that their worth is tied to their professional role.

-

When work defines you, stepping away can feel like a loss of identity.

Breaking it Down:

-

You Are More Than Your Role: Your role as a leader or entrepreneur is just one aspect of who you are. Your values, experiences, passions, and relationships contribute more to your identity than any job title.

-

Redefining Purpose: Retirement doesn’t mean the end of purpose. It’s an opportunity to explore new interests, mentor others, or engage in activities that bring joy and fulfillment.

-

Consider how your skills and experiences can be applied in new ways, whether through philanthropy, hobbies, or personal projects.

Building a New Identity: Start thinking about what excites you outside of work, and start at least a few years before you retire. It takes time to figure out who you are and what you enjoy outside of your work role.

-

What are the things you’ve always wanted to do but never had the time for?

-

This is your chance to embrace a new chapter where your identity can evolve and grow beyond your career.

-

A good starting point? Write your own memoir.

The Bottom Line: Retirement is not the end of your identity; it’s a new beginning. Embrace the opportunity to redefine who you are beyond the title on your business card.

|

|

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

-

Was this email forwarded to you? Subscribe here.

-

Have an idea or issue to share? Email us.

-

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

-

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

-

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋

|

|

|

|

Feedback

Anonymously tell us what you thought of this edition. Your responses will help us create better content for you!

Was this edition useful?

|

|

|

|

Like this email style and format?

It’s called Smart Brevity®. Hundreds of orgs use it — in a tool called Axios HQ— to drive productivity with clearer workplace communications. |

|

|