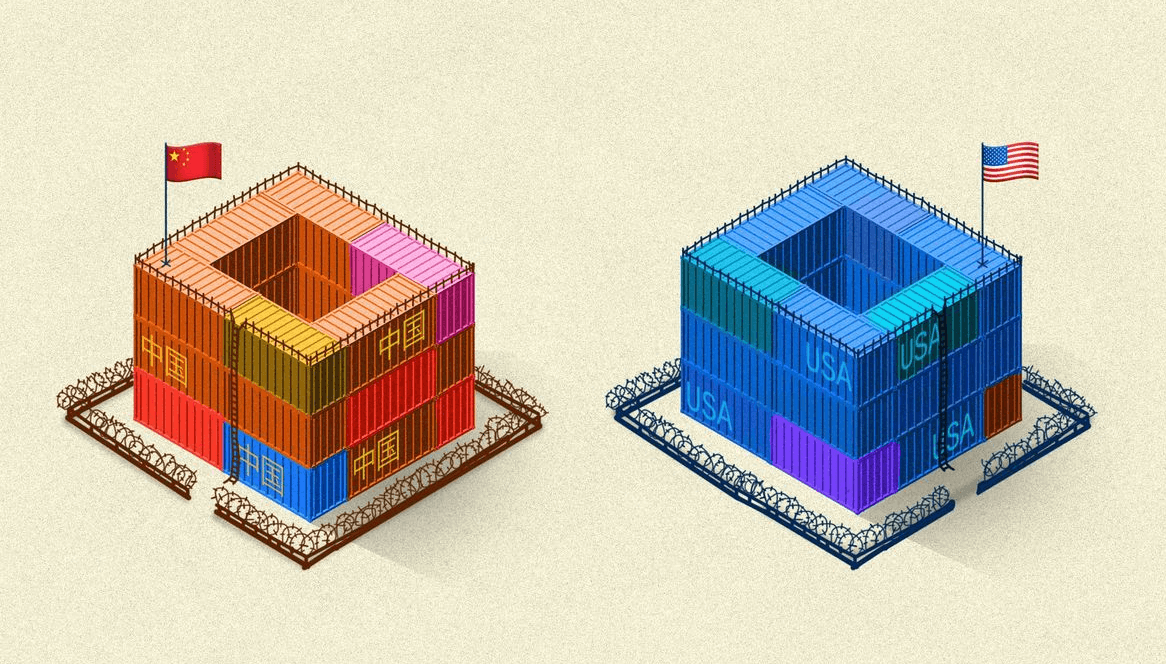

1 big thing: Increasing Restrictions on Chinese Land Purchases

Over two-thirds of states have passed or are considering passing legislation to prohibit Chinese citizens and companies from purchasing U.S. land.

Why it matters: Sales to Chinese entities and nationals could become increasingly complex and costly to ensure legal compliance.

National security concerns: The increase in restrictions on Chinese land purchases stems mostly from Republican-led state governments critical of the federal government’s handling of national security.

-

15 states passed laws restricting or prohibiting Chinese ownership of U.S. lands in 2023.

-

20 states are in the process of passing new restrictions or updating existing laws.

Worth the effort?

-

Proponents of the laws say Chinese ownership poses a threat to American food security.

-

“They are buying up our entire food supply chain,” says Governor Kristi Noem of South Dakota.

-

Overall, Chinese holdings of U.S. lands are minuscule—only 0.03 percent.

-

Evidence that those interests pose a threat to American interests is scant.

The role of CFIUS: The states enacting the restrictive new laws say that land purchase restrictions by the Treasury Department’s Committee on Foreign Investment in the U.S. (CFIUS) don’t go far enough because they only cover certain airports, some maritime ports, and military installations.

Florida’s law targeting “real property and strategic assets,” which passed last summer, has become a model for states such as Hawaii, Illinois, and Iowa.

Yes, but: A federal appellate court blocked that law, finding it violated the Fourteenth Amendment protections against discrimination.

-

The law remains in the appellate process.

Meanwhile, on Capitol Hill: Federal lawmakers continue to push bills that would add farmland to CFIUS review as well as legislation targeting Chinese entities; so far, none have passed.

More state laws on the horizon? Michael Lucci, founder of State Armor, an advocacy group lobbying for legislation limiting Chinese land purchases, says the group plans to push for such legislation in as many as 30 states in the next year.

The bottom line: Even with the fate of Florida’s law up in the air, the push for increased scrutiny of Chinese land purchases is going strong. It remains a legal area to watch.

Go deeper: Letters from an American by historian Heather Cox Richardson

2. Florida Property Insurers Leave $2.2 Billion on the Table

In 2022, the Florida Legislature threw a life preserver to the collapsing property insurance industry in the form of a $3 billion Hurricane Catastrophe Fund. Today, $2.2 billion of that fund remains untouched.

Why it matters: The insurance industry in Florida is showing signs of picking up, thanks to new insurers and more private capital.

-

Some say there are now better uses for the unclaimed money in the fund.

By the numbers: Last year, carriers were filing rate increases of 40 to 100 percent. This year, the increases are lower — and some insurers are filing for rate reductions.

-

Additionally, Eight new companies have been granted permission to sell homeowners’ insurance in the state, five of which are start-ups.

Not reaching the kitchen table: Despite the positive movement in the industry, homeowners won’t feel much relief. Insurance is expected to go up another 7% in 2024, thanks to:

-

Inflation

-

The risk of future hurricanes

-

High cost of reinsurance

-

High cost of replacement materials

Other options for the $2.2 billion left in the Hurricane Catastrophe Fund include:

-

Using it to help lower homeowner insurance rates, which rose 102% between 2019 and 2022.

-

Dividing the cash among Florida’s 7.45 million homeowners, for a one-time payment of $295 per household.

-

Reinvesting the money back into the reinsurance program in preparation for the next major storm.

-

Lending money to companies and investors to entice them into the state.

The bottom line: Florida is in an excellent position heading into what’s expected to be another violent hurricane season, with insurers in better financial condition and more capacity for risk. Everyone’s hoping the $2.2 billion will be used wisely and in Floridians’ best interests.

This week is an episode of “Ask Joe Anything” of the Trust This podcast.

-

Over the past week, I got many questions about wholesaling in light of what’s happening in South Carolina and how to prevent similar legislation from coming to Florida.

-

Here’s what I have to say about it: Listen in or watch on your favorite channel.

3. Catch up fast

-

Job gains continue to be better than expected, meaning the outlook for interest rates to come down any time soon is not great. HousingWire News

-

More sellers are cutting their asking prices, suggesting that price softening could be starting at the start of the summer selling season as for-sale inventory becomes more stale. The Title Report

-

Three of the Top 15 metros with the furthest-falling home prices are located in Florida, but prices aren’t slipping by large amounts. Bigger Pockets

-

Another analysis of Florida’s new HOA laws … from a U.K. perspective. The Guardian

-

Homes for sale are piling up; just not where the buyers want them. Bloomberg (gift link)

-

America is in the midst of an extraordinary startup boom. The Economist

4. Closing Thought

Author Morgan Housel, in his book, Same as Ever, points out that wounds are temporary, but scars are permanent.

Why it matters: Spotting a “wound” can help a business anticipate the scars that will result; and spotting scars and illuminate wounds that have occurred.

-

The “wound” is typically an unforeseen event—tragic, happy, or otherwise memorable—that changes the trajectory of business and possibly society as a whole.

-

The “scar” is the permanent way of thinking or way of doing things that will persist far into the future well after the “wound” has healed.

Some examples:

-

Wound: the 9/11 terrorist attacks on the U.S. 👉 Scar: sky marshals on flights, removing shoes, belts, and laptops at super-high security airport checkpoints for the rest of our lives.

-

Wound: The stock market crash of 1929. 👉 Scar: Grandparents who stockpiled canned goods in pantries and basements for the rest of their lives.

-

Wound: The housing market crash of The Great Recession of 2008-2012. 👉 Scar: Qualified Mortgage regulations, Dodd-Frank restrictions on mortgage financing, developers reluctant to build too far ahead of the market, a scarcity of starter homes, high mortgage rates, and tight credit requirements.

-

Wound: The worldwide pandemic of 2020-2021. (Too soon?) 👉 Scar: Supply chain disruptions; remote working shifts; vaccine backlash; and more we’re feeling everyday ….

Housel opines that reading history voraciously is much more helpful in preparing for future wounds than reading the daily news of current events. He points out that—because history always repeats itself—knowing what wounds have been inflicted will better prepare you for what will happen … and the scars that will result.

The bottom line: Hindsight is foresight. Approaching business (and life) with this outlook better prepares the business and its owner for survival, which is important since only businesses that can survive will ever have a hope of thriving.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

-

Was this email forwarded to you? Subscribe here.

-

Have an idea or issue to share? Email us.

-

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

-

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

-

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋