- Trust This.

- Posts

- Trust This: Commercial Rent Tax Gone

Trust This.

By Joseph E. Seagle, Esq.

👋 Happy Friday! Today is Independence Day 🎇, the 249th anniversary of the signing of the 🇺🇸 Declaration of Independence on July 4, 1776.

❗️Situation Awareness: No more sales tax on commercial rents starting October 1, 2025. See below for more information

1 big thing: 🏗️ Florida Real Estate Gets a Tax Makeover—With Perks for Savvy Structuring and Development

Florida’s new tax law (HB 7031) eliminates the state sales tax on commercial rent, expands tax breaks for affordable multifamily housing, and allows tourist tax revenue to fund infrastructure. These changes directly benefit real estate investors, landlords, and developers, particularly those who structure their investments wisely.

💼 Big win: No more tax on commercial leases

Effective October 1, 2025, businesses no longer have to pay Florida sales tax on leases of commercial property . This is huge for:

Business owners who own their real estate through a separate LLC.

Investors who lease property back to their own operating companies.

🧠 Why this matters for asset protection:

Previously, rent between related entities triggered sales tax—making it costly to structure real estate, business operations, equipment, and intellectual property into separate legal entities. With that tax gone, there’s no longer a downside to adopting this asset-protection-friendly model:

LLC 1 (through a land trust) holds the real estate.

LLC 2 (or corporation) operates the business.

LLC 3 owns equipment.

LLC 4 owns trademarks and IP.

Rents and royalties between these entities are now untaxed at the state level, clearing the way for clean compartmentalization.

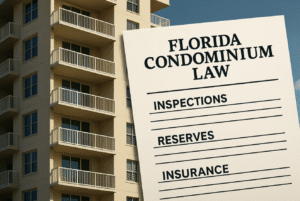

🏘️ Multifamily projects get generous tax relief

New exemptions: Starting in 2026, multifamily properties with 70+ affordable units built on government-owned or leased land may qualify for full ad valorem tax exemptions .

Extended benefits: Properties with existing exemptions can now pass those along to future owners—great news for institutional buyers .

Nonprofit ground leases: Land leased by 501(c)(3)s for affordable housing (99-year terms) is also tax-free through 2059.

⏩ Translation: It’s now easier to pencil deals that provide affordable housing —especially for developers using housing finance authorities or land use agreements.

🌴 Tourist development tax expands to infrastructure

In a move that many of us had thought was a no-brainer for decades, counties can now use up to 70% of their tourist tax collections for infrastructure projects like sewer, water, roads, and drainage — if the goal is to boost tourism, and with 2/3 board approval. This is particularly useful in coastal areas where tourism-linked developments need utility upgrades. Also, we can imagine that county commissioners can be creative when it comes to finding that an infrastructure expense will boost tourism. This should also alleviate some of the cash revenue crunch that the loss of rent sales taxes will cause.

📌 The bottom line: Whether you’re building affordable housing, owning your own storefront, or structuring rental flows between multiple entities or trusts, Florida’s new tax laws make it easier, safer, and more profitable. Asset protection and tax efficiency are no longer in conflict.

2. 🌪️ Florida’s FEMA Future: A Hurricane Recovery Crisis?

What’s happening: President Trump announced plans to eliminate FEMA after the 2025 hurricane season, forcing states like Florida to shoulder full responsibility for hurricane recovery.

Why it matters: Florida received over $4 billion in FEMA aid last year alone — more than any other state. Without federal support, the financial burden could devastate state and municipal budgets.

By the numbers:

Hurricanes Helene and Milton in 2023-2024 cost Florida $23 billion.

Nearly 900 FEMA staff deployed to Florida last year for rescues, cleanup, and emergency aid.

The cancellation of FEMA’s BRIC program clawed back $293M earmarked for infrastructure upgrades like flood-proof sewage stations, and Gov. DeSantis line-item vetoed some programs in the latest Florida budget that would have fortified anti-flooding infrastructure upgrades in places like east Orange County.

Programs like Elevate Florida, funded with $400M, are likely to run dry without renewals.

What they’re saying:

“We’ll see a lot of budgets with glaring red spots,” warns Ratna Dougherty, University of South Florida .

“We don’t have the capacity to do everything FEMA does,” adds Ethan Frey of the Florida Policy Institute .

Reality check for real estate pros:

Insurance rates could spike further as disaster risks rise.

Local governments may hike taxes or fees to fund disaster recovery.

Infrastructure upgrades critical for flood mitigation—vital to property values—may stall.

HUD disaster grants, which brought $1.5 billion to Hillsborough and Pinellas counties, could be next on the chopping block .

The bottom line: If FEMA funding disappears, expect a strained insurance market, weakened infrastructure resilience, and increased financial pressure on both homeowners and investors. Florida’s real estate entrepreneurs should brace for higher risks, explore private mitigation solutions, and monitor policy developments closely.

This week’s episode of Trust This: Ask Joe Anything is a replay of the basics of land trusts.

Most political news lives in the extremes.

It’s either rage bait meant to rile you up, or echo chambers that only reinforce what you already believe. The result? More division, less understanding — and a lot of burnout.

We give you the full story on one major political issue a day, broken down with arguments from the left, right, and center — plus clear, independent analysis. No spin. No shouting. No bias disguised as truth.

In just 10 minutes a day, you’ll actually understand what’s happening — and how all sides see it.

Join 400,000+ readers who are skipping the noise and getting the full picture.

3. Catch up fast

Oh, I’m just a bill, up on Capitol Hill …. (In light of the holiday, this week’s Catch Up Fast section is shorter than usual)

How will Trump’s “Big Bill” affect your wallet (answer yes or no questions to find out)? NY Times (gift link)

How will the Big Bill affect housing? HousingWire (gift link)

The BBB simplified Buchanan

4. Closing Thought: Don’t go chasing dinosaurs

Edward napping with his favorite pink pig

🚀 The Big Idea: Visionaries shouldn’t waste time chasing dinosaurs — outdated models, old-school mindsets, or legacy industries resistant to change. Your energy is better spent chasing the stars — innovation, growth, and future-forward opportunities.

💡 Why it matters: As real estate investors and entrepreneurs, it’s tempting to keep grinding away at what used to work. But the market is shifting. Technology, interest rates, demographics, and consumer behavior are evolving fast. Those stuck clinging to the past risk extinction.

📉 The problem: Many investors still:

Chase outdated business models (e.g., relying solely on single-family flips in saturated markets)

Work with “dinosaurs” — vendors, brokers, or lenders who fear tech, automation, or new deal structures

Get bogged down in old systems instead of leveraging tools like AI, CRMs, and virtual assistants

🌟 The opportunity

The most successful operators today are:

Investing in build-to-rent communities and alternative housing models

Partnering with tech-enabled lenders and digital marketing pros

Automating everything from lead gen to property management

Building personal brands that attract JV partners, clients, and capital

Not just using AI, but learning and imagining new ways to use it to turbocharge marketing, operations, finance, and sales.

✅ What to do next

Audit your current business: What systems or relationships feel fossilized?

Reframe your thinking: Where are your competitors stuck — and how can you leap ahead?

Invest time each week learning from those “chasing stars”: modern entrepreneurs, trendsetters, and disruptive thinkers.

💬 Reality check: You don’t have to burn everything down. But if you’re always looking in the rearview mirror, you’ll miss the rocket ship right in front of you.

👉 Bottom line: Adapt or become extinct. Trade the comfort of dinosaurs for the wonder of the stars. Your future self will thank you.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Was this email forwarded to you? Subscribe here.

Have an idea or issue to share? Email us.

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋

Reply

Keep reading

🚩 Subject-to under siege by AZ AG

Real estate investors, title agencies, and law firms are swept up in the action

🏠 Trust This: Home Equity Contracts are coming

Along with more office conversions to residential apartments.

👋 Trust This: Privatizing Fannie & Freddie

But if stagflation rears its head, the government may have to go even deeper on its bets in Fannie and Freddie that started in the last Great Recession