- Trust This.

- Posts

- Trust This: No capital gains on primary residence sales?

Trust This: No capital gains on primary residence sales?

... and -- adding insult to injury -- taxing denaturalization

Trust This.

By Joseph E. Seagle, Esq.

👋 Happy Friday! On this day in 1986, the world saw the first pictures of the sunken remains of the Titanic, after decades of searching. Coincidentally, today is also the birthday of Margaret Brown, one of the survivors of the Titanic. She was known for the rest of her life as “Unsinkable Molly Brown.”

1 big thing: The No-Tax Home Sale Proposal: Windfall or Longshot?

Rep. Marjorie Taylor Greene (R-GA) has introduced the No Tax on Home Sales Act, a bold federal bill that would eliminate capital gains tax entirely on the sale of primary residences — regardless of income level or profit amount. It’s a sweeping move that’s reigniting debate around the long-untouched 1997 home sale exclusion limits.

📜 The law today: Homeowners currently enjoy a $250,000/$500,000 exclusion on gains from selling their primary residence (single/married filing jointly) once every two years, if they’ve lived there for at least two of the past five years. But those limits haven’t been updated in nearly three decades—even as home values have skyrocketed .

A Floridian who bought in 2012 for $300K and sells today for $850K? Likely owes tax on $50K of that gain.

🧨 Greene’s pitch: Greene argues the tax is now an “unfair burden” on everyday families, especially seniors and long-time owners in appreciating markets. The bill:

Applies only to primary residences

Excludes flippers and investors

Is aimed at unlocking equity and encouraging mobility

She frames it as a way to “bring fairness back to the tax code” and fight the affordability crisis by increasing housing supply

📈 What it could change

Mobility boost: Downsizers and empty nesters might finally list.

Inventory unlock: Tax concerns keep many homes off the market; this could free up millions of units.

Wealth preservation: Especially for boomers with decades of equity gain.

Speculative loophole risk: While investors are excluded, enforcement would need teeth.

🚫 Yes but the bill hasn’t moved out of committee and lacks bipartisan support. Critics call it a handout to the wealthy, citing concerns about lost federal revenue and fairness to renters. Others argue inflation-adjusting the current thresholds is more realistic than scrapping the tax entirely (a policy change we’ve discussed often with clients and policy makers).

📍 Why this matters for Florida pros: Florida’s markets—Orlando, Tampa, Miami—are filled with long-time owners sitting on substantial gains from the past few years of price inflation. Even if this bill fails, its introduction pressures Congress to modernize §121 rules. That’s a talking point worth using in listing appointments.

✅ Action steps for real estate professionals:

Review gain exposure: Help sellers estimate whether they’re hitting taxable thresholds.

Educate on exemptions: Many clients still don’t understand they get a $250K/$500K break.

Monitor tax code changes: 2025 tax reform talks may address outdated exclusions.

Stay ahead of rhetoric: Clients will hear about “no home sale tax”—be ready to explain the difference between proposals and law.

Don’t forget portability: Remind clients that they can port their homestead tax savings to a new homestead as they move to a new homestead in another Florida address.

2. ⚖️ Hypothetical but Real Risk: Denaturalization Could Trigger U.S. Exit Tax

A recent Forbes article raises a chilling hypothetical: What happens if a naturalized U.S. citizen is denaturalized — whether for fraud, misrepresentation, or other grounds—and has a net worth over $2 million?

🚨 Could the IRS impose the exit tax, even though the person didn’t renounce citizenship voluntarily?

🧠 The Law: IRC § 877A

The exit tax under Internal Revenue Code § 877A treats certain high-net-worth individuals as if they sold all assets the day before they cease to be U.S. citizens or long-term residents.

It applies to so-called “covered expatriates” who:

Have a net worth exceeding $2 million, or

Pay average annual income tax over a threshold (≈ $206,000 in 2025), or

Fail to certify five years of tax compliance.

📌 Traditionally, it applies when someone voluntarily gives up U.S. citizenship. But what if it’s taken away?

🧯 The Legal Grey Zone: Denaturalization + Exit Tax

In a hypothetical scenario where a person is denaturalized:

The government may argue that they ceased being a citizen and thus triggered 877A.

Yes, but, the taxpayer might argue ab initio — they were never a citizen to begin with, so there’s nothing to “expatriate from.”

💬 But as Virginia La Torre Jeker notes, there’s no settled law. The courts may side with the IRS, leaving former citizens on the hook for a massive tax bill based on unrealized gains.

🏘️ Why Florida Real Estate Pros Should Care

Florida’s real estate market is a magnet for wealthy immigrants and naturalized citizens with complex portfolios:

If a client is investigated for denaturalization, their assets (especially U.S. real estate) could be taxed as if sold the day before denaturalization.

Title holdings, LLCs, trusts, and even offshore entities may not shield them from phantom gains taxation.

🛡️ Planning Strategies — Before It’s Too Late

✅ Asset review now: High-net-worth clients, especially those born abroad, should assess their exposure if naturalization is ever challenged.

✅ Valuation planning: Step-up basis opportunities (e.g., gifting, selling to trusts) can reduce phantom gain exposure.

✅ Trust structuring: Domestic or foreign non-grantor trusts may shift future appreciation out of personal estates, but must be done years before any action.

✅ Backup citizenship: Clients with dual nationality should weigh whether a voluntary renunciation (with careful tax planning) is safer than risking future forced loss.

✅ Five-year tax compliance: Clean records matter. Failure to certify can trigger covered expatriate status even at modest wealth levels.

🧭 The Bottom Line

This is a hypothetical for now. But with increased DOJ focus on denaturalization, especially in civil fraud cases, wealthy immigrants are newly exposed. Also, while likely unconstitutional, even the president has threatened to denaturalize at least one wealthy celebrity and even his former “first buddy.”

📣 Real estate professionals should work with legal and tax teams to help clients:

Understand the risks

Restructure holdings

Plan exit options proactively before it’s forced upon them

Because in the IRS’s eyes, citizenship may not be forever — but tax liability might be.

Tom Ruggie of Destiny Family Office joins me this week on a Tactics and Strategies episode of the Trust This podcast. He explains what a family office does and why high-net-worth families should have one on their side to ensure their legacy passes from one generation to the next, for multiple future generations.

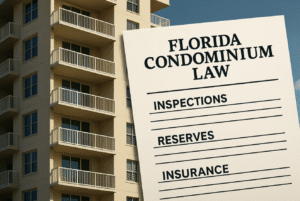

3. Catch up fast

Florida condo reform could open litigation floodgates Newsweek

Residents of this condo pushed to sell rather than pay to meet new safety requirements Yahoo!

Homeowners are behind on mortgage payments - see where your state ranks Realtor

Trump’s proposed HUD time limit puts 1.4 million of the nation’s poorest renters at risk ABC News

Foreign buyers spent $56 billion on US homes last year with Florida accounting for over 20% of the purchases NY Post

The top 10 states with the most stable housing markets CNBC

HOA battle sends mom to jail AOL

Four things we learned from the latest CPI report on rising inflation MarketWatch

Home sellers fed up with price reductions are yanking listings Fortune

It’s a question of when, not if, the dollar is no longer the currency of reserve for the world The Guardian

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

4. Closing Thought: 🧠 Ego-Free Success Is the Real Flex

Sunset at 9:00 pm somewhere around 30,000 feet above Atlanta

In real estate, and business at large, the loudest voice in the room often isn’t the most successful one. As Ryan Holiday reminds us, “Most successful people are people you’ve never heard of. They want it that way.” Why? Because ego is a liability.

Why it matters: For small business owners and real estate investors, ego can distract from what truly matters: building wealth, creating systems, and serving clients. The quiet achievers? They’re the ones closing deals, optimizing operations, and stacking assets—without needing applause.

By the numbers:

90% of millionaires in the U.S. are self-made, but only a fraction of them are public figures.

The average real estate investor you’ve never heard of owns 3–5 doors and is quietly compounding net worth while their peers chase social clout.

More than 60% of small business owners cite “internal mindset” as a greater barrier than capital or competition.

Between the lines: Ego can lead to bad deals, overleveraging, poor partnerships, and brand decisions based on vanity instead of ROI. The most effective entrepreneurs build quietly, protect their privacy, and focus on outcomes; not optics.

What to do next:

✅ Build a brand that serves your clients, not your ego.

✅ Track your net worth, not your likes.

✅ Focus on the boring systems that lead to extraordinary results.

✅ Avoid “loud money” traps—cars, watches, influencer energy.

✅ Protect your name, assets, and identity. (Land trust, anyone?)

The bottom line: You don’t need to be famous to be free. You need to be disciplined, humble, and willing to do the work without applause. The world doesn’t need to know your name, but your bank, your family, and your legacy will.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Was this email forwarded to you? Subscribe here.

Have an idea or issue to share? Email us.

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋