|

|

|

|

Trust This.

By Joseph E. Seagle, Esq. ● Oct 07, 2022

Smart Brevity® count: 4 mins...1071 words

Happy (dry) Friday! It’s also World Smile Day, so be sure to pass along a smile Happy (dry) Friday! It’s also World Smile Day, so be sure to pass along a smile  to someone who needs it. to someone who needs it.

|

|

1 big thing: Updating disclosures

Homeowners who listed their homes for sale prior to Hurricane Ian will have to update their seller disclosures if the property flooded or otherwise suffered any damages from the hurricane.

Why it matters: This can push prices even lower than they were heading before the storm.

Even if selling a property, using an As-Is contract form, or if the owner has never lived in the property, the seller is required to disclose all known but hidden defects they know about the property.

-

If any portion of the property is flooded, it must be disclosed.

-

If the roof was damaged, it must be disclosed.

-

If the windows or doors leaked during the storm, it must be disclosed.

-

If the sewer or septic tank backed up into the home, it must be disclosed.

If a seller fails to disclose these matters after they have fixed the damage, then they may be on the hook to reimburse the buyer.

State of play: Agents, investors, and others selling a home:

-

Search for a physical or electronic copy of prior seller disclosure forms for the property in your office files. Review them, even if you weren’t the listing agent in the past, to refresh the seller’s memory.

-

Go back through pictures of the property taken over the years to see if there is any evidence of past work done on the property. Many owners take pictures of the damage and then of repair work.

-

Review bank and credit card statements for payments to contractors.

-

Homeowners should keep a file of major repair work done, including notes from contractors suggesting that work or repairs be done, even if they never are.

-

Buy a home warranty for the buyer at closing.

The bottom line: There are additional lines on the disclosure form. Use them wisely.

|

|

2. Insurance insurance insurance

Estimated losses from Hurricane Ian range from as low as $11 billion to as high as over $100 billion.

Why it matters: The consensus is that it will be devastating for Florida’s struggling property insurance industry, leading at least one legislator to press for a special session again to consider legislation to fix the problems. The danger is real.

-

Six insurers so far this year have failed, and FedNat Insurance was declared to be insolvent on the day Ian became a tropical storm for the first time.

-

FedNat had planned to do a soft close-out where it would not renew any policies as they expired. But the company later realized it didn’t have the cash to do that.

By the numbers: Florida’s homeowners’ insurance premiums are the highest in the nation. Some estimates of covered losses range between $25 billion and $40 billion which would push rates higher to replenish insurers’ reserves after the storm damage is covered.

Yes, but: Insurance is complicated.

-

There are safeguards such as higher deductibles during hurricanes that protect insurers from having to pay 100% of a claim.

-

And damages caused by storm surges and rainfall aren’t covered by regular homeowners’ insurance. So a lot of the damages caused by the storm won’t affect insurers.

-

Meanwhile, homeowners without flood insurance (most of them in Central Florida) will be — at best — eligible to receive less than $40,000.00 from FEMA to repair their homes.

What we're seeing: Clients and customers with no flood insurance have lost almost everything. With homes now uninhabitable, and cars ruined, a lot of friends and neighbors who were once financially fine will be struggling. Unless Congress or the Florida Legislature can find more funds to help out, these Floridians will have a bleak financial future.

Go deeper: Tampa Bay Times

|

|

4. 2022 home sales down 13%

-

The post-storm affordable housing crisis will be worse than it already was. Axios Tampa Bay

-

According to CoreLogic’s Chief Economist in a housing market update presented yesterday by October Research:

-

YTD total home sales are down 13%.

-

About 1/3 of homes still sell over the asking price.

-

Mortgage interest rates are expected to ride over 6.5% for the last quarter of this year and increase more in 2023.

-

Affordability is at the lowest level on record.

-

Home price growth is forecast to be 3% in 2023.

-

Mortgage originations are forecast to be 45% less than they were last year with refinances taking the biggest hit and purchase loan originations remaining about the same for 2021, 2022, and 2023

-

The share of adjustable rate mortgages is the highest it’s been in 8 years rising from 4% of all mortgage origination in January 2021 to 20% of all originations in July 2022.

-

First-time homebuyers’ share of all purchases has fallen back to a pre-pandemic level of 36%.

-

The active inventory of for-sale homes is up 32% between January and August while new listings are slowing dramatically as sellers with “golden handcuffs” of low interest rates can’t afford to buy a replacement home at a much higher rate.

-

CoreLogic forecasts that 2022 sales will be down 15% year-over-year from 2021, and 2023 will see sales drop an additional 6%.

-

Single-family investors’ share of the purchase market is on the rise at 25% of all sales nationwide, but most investor activity is still in California and Texas.

-

Miami, at 27.1%, had the highest price growth between July 2021 and 2022 across US metros.

-

Most of Florida is facing a 70% chance of price declines in 2023.

-

Serious mortgage delinquencies are back to pre-pandemic levels and should stay there so long as unemployment remains low.

|

|

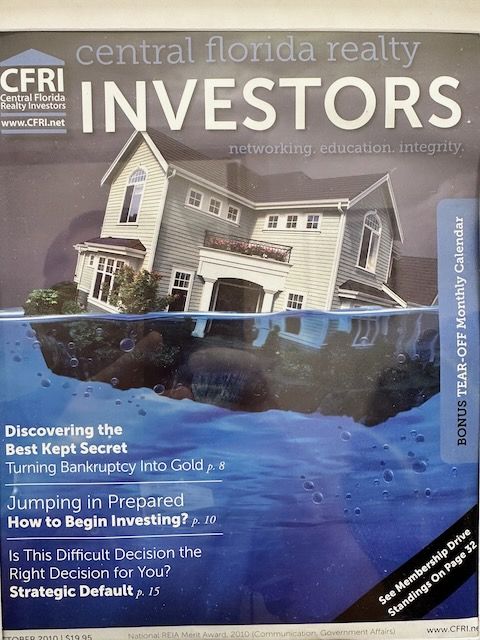

Cover of a 2010 CFRI Magazine. Foreshadowing?

This CFRI newsletter cover from 2010 was hanging in the hallway Thursday evening as I entered the room to teach a seminar on land trusts and subject-to transactions. I’d walked by it many times unnoticed, but this week it hit home so to speak.

I don’t know why, but in this PTSD post-hurricane week, this rockin’ 90’s TV show’s theme song keeps running through my head. For some reason, it gives me a little comfort after the storm.

|

|

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Be on the lookout for our next issue!

|

|

|

|

Was this edition useful?

Your responses are anonymous

|

|

|

Powered by

|

|

|