A local Florida state senator proposed that a special tax be assessed on out-of-state companies and individuals investing in Florida real estate.

Part of a three-part plan laid out by Sen. Randolph Bracy, the tax portion is a new twist. It would apply to housing purchased by corporations and individuals with out-of-state addresses, including “snowbirds.”

The other two parts of the plan call for local incentives for the development of community affordable housing and tax breaks and grants for developers willing to set aside portions of new developments for affordable housing.

What's next: A potential ballot measure that would put a one-year cap on rent increases is also on the table at next week’s Commission meeting.

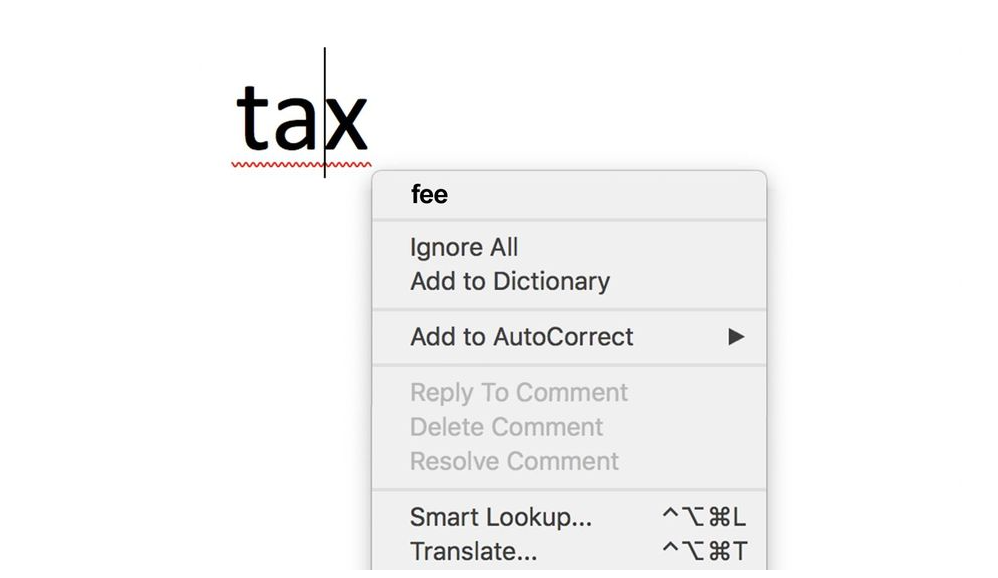

The tax would function much like the “tax” or fees that new incoming residents pay when registering their car in Florida. These fees or taxes would be used to finance affordable housing incentives.

Other states with income taxes charge a tax that is collected when a non-resident of the state sells real estate located in the state. The tax is a percentage of the sales price and is collected at closing and then sent to the state’s revenue department. So it’s not unheard of.

Avoiding the tax would be easy for corporations, and constitutional issues will need to be worked out.

The bottom line: These are just proposals. To be part of the discussion, participating in the August 9 meeting is essential.

Go Deeper