1 big thing: Zombie mortgages: They’re back.

Zombie mortgages—second mortgages borrowers forgot about or believed forgiven—are suddenly being called in. The result is a tidal wave of surprise foreclosures.

The undead: Lenders who stopped pursuing foreclosure on a second mortgage in default, deeming it not worth the expense and trouble, might have given borrowers the impression the debt was canceled.

Imagine their horror when they see that loan rearing back up, propelled by lenders trying to beat the statute of limitations.

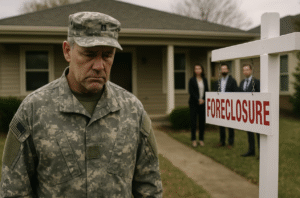

What it means for borrowers: Debt collectors are now buying these old loans and pursuing repayment aggressively. Borrowers who can’t pay could find themselves out on the street.

By the numbers: In New York alone, about 10,000 homeowners face foreclosure on zombie mortgages.

This is a sequel, by the way. Zombie mortgages first appeared in 2008, and they affect both first and second mortgages.

Today, nearly all of the zombies are seconds.

Making a killing: Analysts say that debt collectors’ sudden passion for long-lost second mortgages is driven by the phenomenal rise in home prices in recent years.

Capitalizing on the homeowners’ hard-earned equity, collectors can foreclose on a property, sell it, and pay off the primary mortgage with plenty of cash left over.

Plus, they often add retroactive fees and interest. This may not be 100% legal, but it’s happening.

Recourse for homeowners? Not much.

The foreclosure process is heavily regulated, and any lender who fails to cross T’s and dot I’s should have to forfeit their property rights.

Borrowers who believe they’ve been deliberately misled may be able to stop proceedings under the Truth in Lending Act , the Real Estate Settlement Procedures Act, and other defensive statutes and case law available.

They’ll also have a good case if the debt collectors fail to provide consistent monthly statements or any warning before a final bill and foreclosure.

Anyone caught in a zombie mortgage should seek legal representation immediately, says David Weber, a professor at Creighton University School of Law. A court could waive the fees and interest and might quiet the second mortgage from the title.

The bottom line: More and more homeowners are being stalked by zombie mortgages, and foreclosure activity is on the rise.

Anyone with a mortgage should check their property title for encumbrances or liens they’re unaware of.

2. Commercial Mortgage Delinquencies Are On the Rise

In the first quarter of 2024, as interest rates rose and property values continued to be uncertain, commercial mortgage delinquency rates also increased.

Why it matters: The rate of delinquencies is a good indicator of just how stressed the commercial real estate market is. The fact that the rate continues to trend upward doesn’t bode well.

Who’s falling behind:

Banks are noticing a precipitous increase in 90+ day late or non accrual loans (loans on which the borrower is significantly behind, so the lender stops accruing interest).

Life insurance companies’ delinquencies rose to 0.52% for loans that were over 60 days late.

Fannie Mae’s delinquency rate decreased slightly but was still around 0.45%.

All about the rates: Interest rate hikes over the past year or two have strained borrowers to the max.

Similarly, higher capitalization rates add much undue pressure to property valuations.

Banks are preparing to take a hit: The increase in non-accrual loans at banks is cause for concern about repayment ability. Plans to handle widespread defaults are underway at many.

A Florida Atlantic University study finds unnervingly lopsided commercial real estate loan balance sheets at the largest US banks, with some accounting for 300% more than their total equity capital.

“This is a very serious development for our banking system as commercial real estate loans are repricing in a high interest-rate environment,” one of the study’s authors notes. “With commercial properties selling at serious discounts in the current market, regulators will eventually force banks to write down those exposures.”

Takeaways for CRE investors:

Expect lenders to tighten their credit standards.

Reassess your risk tolerance.

Make sure property valuations reflect current conditions.

Keep an eye on the Fed: Future interest rate adjustments could affect your bottom line.

3. Catch up fast

What luxury homebuyers want. Redfin

The pace of new homes under construction has hit its lowest level since the pandemic. MPAMagazine

Disney’s L.A. employees who were told to move to Orlando to work in the planned $1 billion Lake Nona Campus, which has now been canceled, have sued the company. Los Angeles Times via Apple News

Florida could pay $2 for every $1 you spend on wind mitigation for your home to harden it against hurricanes under the My Safe Florida Home program. ClickOrlando

Average mortgage rates continue their decline toward 7%. HousingWire

Elevated housing slowdown risk persists in certain markets. Attom

Available homes for sale in Orlando surpassed 10,000 for the first time since May, 2016, helping lower prices as the listings grow stale. Orlando Business Journal (Subscription Required)

Airbnb is pairing up with small investors to fight its legal battles, but it could be too late. Bigger Pockets

4. Closing Thought

Business owners must understand how to handle crucial conversations well.

Why it matters: Crucial conversations occur when there are high stakes, emotions are running high, and there’s a difference of opinion.

It sounds simple, but spotting the point when you’ve entered into a crucial conversation is not always easy.

Adrenaline cranks up.

Blood rushes from the brain to muscles to prepare to fight or flee.

The amygdala (lizard brain) takes over, so rational thinking in the pre-frontal cortex is muted.

You say mean and hurtful things, or — worse — you become sarcastic, passive-aggressive, or walk away without resolving the issue of the conversation.

Know thyself to catch when you’re falling into a crucial conversation based on how you’re reacting to the other person.

Assessments such as PRINT, DISC, and Kolbe can illuminate your triggers and how you react to them.

Knowing your triggers and those of your other crew members will help you recognize when your or their emotions are turning in an unproductive or even hurtful direction.

So, what do you do once you’re inside of a crucial conversation?

Keep your eye on the prize — what you really want to accomplish from the conversation — instead of trying to win the argument.

Maintain the safety of the conversation by keeping in mind what is being discussed and how they respond.

Spot the turning point of the conversation by noting body language and voice tone.

Pay attention to your own reaction and note when you revert to your personal style of responding to stress — withdrawing, sarcasm, anger…., etc. — and take a beat before proceeding.

To ensure the content is safe, clarify a common purpose and mutual respect for each other. If either party senses an ulterior motive in the conversation, it can destroy the respect and common purpose.

The bottom line: Be in charge of the story running in your head as you have the crucial conversation. Control your emotions by frankly acknowledging your feelings out loud and clarifying the story that you’re telling yourself about the other person to encourage feedback.

While this may sound “woo woo,” it’s just one step toward building an emotional intelligence superpower, helping you succeed in business and life.

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Was this email forwarded to you? Subscribe here.

Have an idea or issue to share? Email us.

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋